Consolidation Continues at Historic Pace with 30-Plus Distributors Acquired in 2022

The new year started off with a bang on the M&A front with the news that three large regional distributors were acquired.

Sonepar got out of the gate fast in 2023 with the news that it acquired HOLT Electrical Supply, St. Louis, MO, through Springfield Electric Supply, Springfield, IL, and NEDCO, Las Vegas, through Codale Electric Supply, Salt Lake City, UT. A few days later, Rexel announced its acquisition of Buckles-Smith, Santa Clara, CA, one of the largest independent distributors in California.

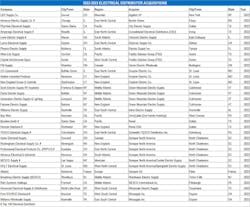

These acquisitions follow what was one of the busiest acquisition years in recent memory. Electrical Marketing and Electrical Wholesaling logged more than 30 distributor acquisitions in 2022, and 13 of these companies were large enough to be ranked on EW’s Top 150 listing (see chart below). The 13 companies that have been acquired over the past 12 months have an estimated combined revenue of $1.3 billion, according to EW data from the Top 150 and sales-per-employee estimates.

Acquisition activity appears to have ramped up for several reasons. Some sellers may have wanted to consummate a deal before a possible recession. The wave of baby boomers retiring in the industry is probably a factor, as is the post-Covid, life-is-too-short philosophy of folks who want to enjoy life now after the scare of Covid. There have also been plenty of examples of distributors from the same buying/marketing groups getting together for a deal.

In many of the acquisitions, you can see acquirers that wanted to enter a new geographic market or bolster an existing presence in a metropolitan area. That was the case with Elliott Electric Supply’s purchase of Kansas City Electrical Supply, Kansas City, MO, and several of Sonepar’s 2022-2023 acquisitions, including Holt Electrical Supply, NEDCO, Rockingham Electrical Supply Co., Newington, NH, and Professional Electrical Products (PEPCO), Eastlake, OH.

Other acquirers wanted to add to geographic coverage for a key product line, as was the case with Rexel’s purchase of Buckles-Smith and Horizon Solutions, Rochester, NY, which both carry the Rockwell Automation line. Graybar Electric Co., St. Louis, MO, was also looking to bolster its industrial automation business with its acquisitions of Walker Industrial Products, Newtown, CT; and New England Drives & Controls, Southington, CT, as well as its 2020 acquisition of Shingle & Gibb Automation, Moorestown, NJ.

Facility Solutions Group, Austin, TX, also made two acquisitions to get into specialty markets, with its recent acquisition of West-Lite Supply, Cerritos, CA, a specialty lamp distributor, and Capital Architectural Signs, Austin, a sign specialist.

While it’s impossible to predict if the rapid pace of M&As activity will continue at the same rate, chances are that the big acquirers will continue to fill in their geographic maps when the opportunity arises and that smaller strategic acquisitions will continue in 2023.

Click here to access Electrical Marketing's database of electrical distributor acquisitions