Surge in Distributor Acquisitions Continues with Billions in Sales Changing Hands

The recent acquisitions of Mayer Electric, Advanced Technical Sales and Atlanta’s HESCO are the latest examples of the continuing consolidation of the electrical industry. EM has reported on several hundred distributor M&As for the past 40 years, and the newsletter’s editors have seen the pace of acquisitions accelerate and moderate throughout many business cycles.

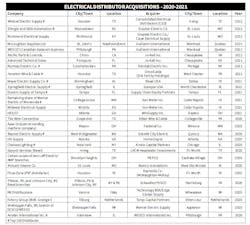

Acquisitions are on the rise again, and over the past two years the deals have gotten bigger and more frequent. Since Jan. 2020 there have been no less than 25 distributor acquisitions in the United States and Canada with an estimated combined total sales volume of at least $9.3 billion, according to EM data on the transactions. That’s roughly 9% of the industry’s estimated total 2020 revenues of $103 billion.

A large chunk of those acquired sales can be attributed to WESCO’s purchase of Anixter, with more than $7.1 billion in 2020 revenues, and the Rexel acquisition of Mayer Electric Supply and its $1 billion-plus in revenues.

After accounting for these two mega-deals, you still have no less than $1.1 billion in sales changing hands in 2020-2021. Although on a percentage basis the 20-plus other acquisitions don’t account for a large share of total industry sales, many of the companies were well-known, family-run regional businesses counted amongst the 200 largest distributors in North America.

Some of the larger electrical distributors that were sold over the past year include Springfield Electric Supply, Springfield, IL (Sonepar); Wildcat Electric Supply, Houston (CED); Shingle & Gibb Automation (Graybar); Houston Wire & Cable (Omnicable/Dot Family Holdings); Electric Supply of Tampa, Tampa, FL (Supply Chain Equity Partners); Baynes Electric Supply, West Bridgewater, MA (Granite City Electric); Rumsey Electric, Conshohocken, PA (Kendall Electric). Electrical Marketing’s list of 2020-2021 acquisitions is below, and its complete distributor acquisition database is available for download at www.electricalmarketing.com.

The timing for the sale of any acquisition is always dependent on when the seller thinks they can best get maximum value for their company. But with uncertainty about the short-term growth prospects of the electrical business fueled by concerns over COVID-19, some industry insiders familiar with the acquisition climate say some business owners have decided now is the time to cash out and start enjoying the fruits of the labors.

According to Pitchbook’s 2Q 2021 Global M&A Report, a contributing factor is concerns of potential tax changes. Pitchbook said in this report that they are “driving a one-time bump to M&A activity in the U.S. The rumored increase in the marginal capital gains tax rate from 20.0% to 39.6% is spurring many family-owned businesses to consider selling one to three years ahead of schedule to prevent paying higher taxes on a sale.”