Lumileds and Auto Lighting Valued at $3.3 Billion in Philips Sale

Following the transaction, the new company will continue under the name Lumileds, led by CEO Pierre-Yves Lesaicherre. Philips said its Lighting Solutions business, slated for separation from the parent company next year through an initial public offering (IPO), will remain an important customer of Lumileds and will continue the existing innovation and supply partnership.

“We have significantly improved the performance of the LED components business and optimized the industrial footprint in the Automotive lighting business over the last few years, and established a strong management team and innovation pipeline,” said Frans van Houten, CEO of Royal Philips. “We are therefore convinced that together with GO Scale Capital, Lumileds can grow further, attract more customers and increase scale as a stand-alone company.”

GO Scale Capital is a new investment fund sponsored by GSR Ventures and Oak Investment Partners. The consortium partners are Asia Pacific Resource Development, Nanchang Industrial Group and GSR Capital.

“GO Scale Capital will focus on expanding Lumileds’ opportunities by investing in its global centers of operation and in the fast growing general lighting and automotive industries. Through Lumileds’ world-leading technology in key verticals such as LED chips, LED mobile flash and automotive lighting, together with a customer base including the likes of BMW, Volkswagen and Audi, we expect to see significant growth and unparalleled inroads into new opportunities such as electric vehicles,” said Sonny Wu, co-founder and managing director of GSR Ventures and chairman of GO Scale Capital, who will serve as interim chairman of Lumileds following the completion of the transaction.

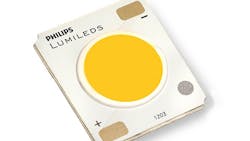

Lumileds is a supplier of lighting components to the general illumination, automotive and consumer electronics markets with operations in more than 30 countries and has approximately 8,300 employees worldwide. In 2014, it generated sales of approximately $2 billion and a double-digit EBITA margin, Philips said in the release.

About the Author

Doug Chandler, Senior Staff Writer

Executive Editor

Doug Chandler began writing about the electrical industry in 1992, and still finds there's never a shortage of stories to be told. So he spends his days finding them and telling them. Educationally, he's a Jayhawk with an English degree. Outside of work, he can often be found banging drums or harvesting tomatoes.