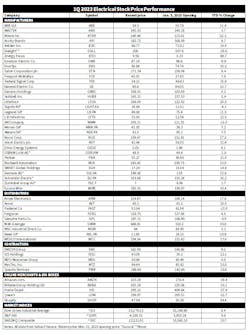

Distributors Lead Electrical Stocks for 1Q 2023 with +17.6% YTD Group Return

Electrical stock prices showed some nice progress in 1Q 2023, after a very forgettable 2022. When looking at the average 1Q 2023 growth for share prices of publicly held electrical manufacturers, distributors and contractors, all three groups comfortably outpaced the S&P 500 average’s +6.6% growth for the first quarter. Very few of the electrical companies that Electrical Marketing’s editors track didn’t match this growth mark. The electrical manufacturers with slower growth for the quarter for the included Generac (+5.2%); Hubbell (+2.4%); Signify (-4.3%); Emerson Electric (-9.8%); and Dialight (-35%). Let’s look at the top performers in each of these groups.

Electrical manufacturers

As group, electrical manufacturers’ share were up +10.7% for the quarter. Shares for 24 of the 35 manufacturers that Electrical Marketing tracks topped the S&P average for 1Q 2023, and 18 companies enjoyed double-digit gains in their share prices for the quarter. Top performers include Encore Wire (+33.4%); Atkore (+22.1%); Littelfuse (+20.3%); Schneider Electric (+16.2%); Siemens (+15.8%); Rockwell Automation (+13%); Legrand (+11.5%); and ABB (+11.4%). Of the manufacturers mentioned here, ABB’s stock is the only one currently near a 52-week high. It closed that quarter at $34.30 per share.

Electrical distributors

The shares of the publicly held distributors had an even stronger quarter, with the group average up +17.6% for 1Q 2023. W.W. Grainger led the pack with a YTD gain of +35%. Rexel’s stock also checked in with some super gains, registering an increase of +20.9% YTD, and WESCO also came in strong with a quarterly gain of +17.6%. Surprisingly, Fastenal, normally one of the best-performing stocks that EM tracks, lagged the group with a -13% decline in its share price since Jan. 3.

Electrical contractors

It was another strong quarter in the stock market for Quanta Services. Its shares are up +16.6% since the beginning of the year, and led EMCOR Group’s shares, which increased +9.2% for the quarter.

There were some surprising share price declines in a category that in the past has often shown the most growth — online merchants and home centers. Shares of Amazon saw the biggest drop and were down -39.4% for the quarter. The stocks of Home Depot and Lowe’s, which generally are among the top performers amongst the companies that EM tracks, were both down more than -20%.

Summary. With concerns over the health of regional banks and their balance sheets and the lingering forecasts for a possible recession in the not-too-distant future, the overall climate on Wall St. remains volatile. However, if electrical stocks continue to outperform the market indices as they did in the first quarter, share price returns should weather the storm reasonably well.