Distributors See 2025 Electrical Sales Growth to Be a Rather Pedestrian +2%

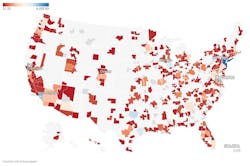

The electrical industry is tracking for slow growth in 2025 after a steady but not spectacular year in 2024. Electrical Marketing’s updated estimated electrical sales potential data pegs sales growth at +2% nationally and is forecasting $148.8 billion in total electrical sales (not adjusted for inflation).

It’s interesting to note that Electrical Marketing’s editors saw the same growth rate by using the EW's Market Planning Guide’s Sales-per-Employee Market and applying it to the latest available local employment data from the U.S. Bureau of Labor Statistics (a three-month average through Sept. 2024) and through an admittedly small sampling of respondents to a survey for the Market Planning Guide, that together forecasted +2% growth for 2025.

In addition, in the most recent Electrical Wholesaling/Vertical Research Partners quarterly survey, respondents saw similar pedestrian growth of +2.8% for Q4 2024.

While these national forecasts are under Electrical Wholesaling’s annual industry growth average of +4% to +8% year-over-year (YOY) growth, quite a few states and Metropolitan Statistical Areas (MSAs) are growing at much better than the national YOY rate, according to our estimates. At the state level, the states currently growing the fastest are Alaska (+15.1%); Hawaii (+11.1%); Nevada (+9.5%); Montana (+8%); Oklahoma (+5.6%); Utah, Florida and South Dakota (all up +5.1% YOY).

Local Sales Stars in the Eastern Region

We will be looking at some of the fastest-growing markets in the Eastern region of the country in this issue ) and will be covering the fastest-growing local markets west of the Mississippi in Electrical Marketing’s next issue on Dec. 6. With $168.9 million more in estimated sales over last year and +7.4% growth, The Miami-Fort Lauderdale-West Palm Beach, FL, is seeing more growth right now than any other MSA. Contributing to this growth is an increase in electrical contractor employment through September of an estimated 1,750 employees (+8.8%), according to an analysis of U.S. Bureau of Labor Statistics data and a surge in population growth. This market saw positive net migration numbers with an increase of 32,663 new residents, according to U.S. Census data. This works out to roughly 89 new residents moving into the Miami market each day.

Other markets east in the Eastern Region with impressive sales potential growth include Charleston-North Charleston, SC, MSA (+7.4%); Detroit-Dearborn-Livonia, MI MSA (+7.1%); Crestview-Fort Walton Beach-Destin, FL, MSA (+7%); and Richmond, VA, MSA (+6.9%).

Although current sales forecasts are on the light side, EW survey respondents were almost universally bullish on the impact of the Presidential election results. Said one respondent when asked about the impact of Trump being elected, “Very strong. Lower inflation, lower energy, lower interest rates, less Federal regulation and more legal action against Government overreach.”

Respondents also saw steady or improving growth in several key markets, including multi-family construction and industrial MRO work. Other markets that scored high in the EW survey included commercial lighting retrofits, educational new construction in K-12 schools, colleges and universities and data centers.

Some evergreen key concerns surfaced when respondents were asked about their biggest challenges for 2025. Finding and keeping good employees was by far the leading concern, followed by running a profitable business and product price increases.

Click on Link Below to Download Electrical Marketing's Electrical Sales Potential Estimates

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).