Single-Family Housing Loses Momentum Nationally, But Some Sunbelt Metros Still Shine

On a national basis, single-building permits were down -1.7% in April and -9.2% in May. The May building permit data for local metropolitan areas won’t be out until after this issue goes to press. Rising mortgage rates and supply chain issues have tamped down demand for new housing in many markets.

Single-family housing data is a good leading indicator of future economic activity because builders don’t typically pay for building permits unless they are close to breaking ground on new homes. Once those homes go in, they are usually followed by strip shopping centers and other light commercial and retail construction.

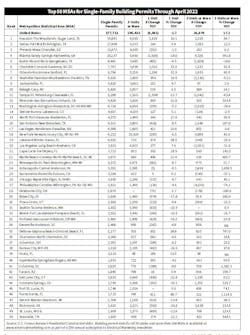

The residential market continues to be quite consolidated, with Florida and Texas accounting for 10 of the Top 50 metros for single-family building activity. In April, the 10 metropolitan statistical areas (MSAs) with the most single-family building permits were Houston; Dallas; Phoenix; Atlanta; Austin, TX; Charlotte, NC; Orlando; Nashville, TN; Jacksonville, FL; and Raleigh, NC. Of the 50 biggest markets for single-family permits (see chart on page 2), the Atlanta-Sandy Springs-Alpharetta, GA MSA (-1,926 permits) and Tampa-St. Petersburg-Clearwater, FL MSA (-1554 permits) saw the largest year-over-year declines.

The Orlando-Kissimmee-Sanford, FL MSA (+1,206 permits); Houston-The-Woodlands-Sugar Land, TX MSA (+1,1819 permits); and Charlotte-Concord-Gastonia, NC MSA (+1,013 permits) were all tracking above the national trendline with double-digit YOY increases in permit activity.