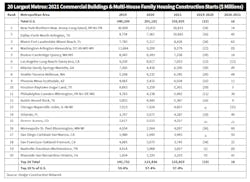

Top 20 Metros Dominate 2021 Commercial & Multi-Family Construction with 57% Share

The value of commercial and multi-family construction starts in the top 20 metropolitan areas of the U.S. increased +18% from 2020 to 2021, according to Dodge Construction Network. Nationally, commercial and multi-family construction starts increased +16% in 2021. In the top 10 metro areas, commercial and multi-family starts rose +18% in 2021, with two metro areas, Washington, DC, and Los Angeles, posting a decline. In those metropolitan ranked #11 through #20, commercial and multi-family starts rose +17% in 2021, with Chicago and Nashville, TN, losing ground from 2020.

Commercial and multi-family construction starts staged a solid recovery in 2021 following stalled projects and growing uncertainties that plagued the industry in 2020. However, Dodge said commercial and multi-family construction starts remain below 2019 levels, highlighting that the sector has yet to fully recover from the impact of the pandemic. In fact, larger metro areas have struggled to gain momentum as demand for construction shifts away from denser urban areas.

In the top 20 metro areas of 2021, Dodge said commercial and multi-family starts were -5% below the level recorded in 2019, and national commercial and multi-family starts were -2% below the 2019 level. In the top 10 metro areas, commercial and multi-family starts were -9% below their 2019 levels, while starts in the metro areas ranked #11 to #20 were up +5% from 2019. This reveals that in 2021, smaller, less dense metropolitan areas are becoming increasingly popular.

The New York metropolitan area was the top market for commercial and multi-family starts in 2021 at $26.8 billion, an increase of +14% from 2020. The Dallas, metropolitan area was in second place, totaling $10.7 billion for the year, an impressive +45% gain over 2020. The Miami metro area was ranked third in 2021, with commercial and multi-family starts totaling $8.4 billion, a dramatic +65% increase over 2020.

The remaining top 10 metropolitan areas through the first half of 2021 were: Washington, DC: -9% ($8.4 billion); Boston: +16% ($7.3 billion); Los Angeles: -12% ($7.1 billion); Atlanta: +49% ($6.6 billion); Seattle: +48% ($6.2 billion); Phoenix: +11% ($6 billion); and Houston: +5% ($5.5 billion).

In summary, the top 10 metropolitan areas accounted for 39% of all commercial and multi-family starts in the United States, unchanged from their 2020 share.

The second-largest metro group included Philadelphia: +30% ($5.5 billion); Austin, TX: +9% ($5.4 billion); Chicago: -31% ($4.9 billion); Orlando, FL: +40% ($4.3 billion); Denver: +21% ($4.3 billion); Minneapolis: +60% ($4.1 billion); San Diego: +93% ($3.9 billion); San Francisco: +22% ($3.7 billion); Nashville, TN: -8% ($3.7 billion); and Riverside, CA: +41% ($3.1 billion).

This secondary group of metro areas accounted for 18% of all commercial and multi-family starts in 2021, unchanged in share from the previous year.

The commercial and multi-family total is comprised of office buildings, stores, hotels, warehouses, commercial garages and multi-family housing. Not included in this ranking are institutional projects (educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single-family housing, public works and electric utilities/gas plants.

In 2021, total U.S. commercial and multi-family building starts rose +16% to $236.6 billion from 2020. Nationally, commercial starts were up +8% to $120.3 billion, while multi-family starts were +25% higher at $116.4 billion. Within the top 10 metro areas, commercial building starts rose +11% to $45.1 billion in 2021, while multi-family starts gained +25% to $48.0 billion. Within the second largest group of metropolitan areas, commercial building starts declined -4% in 2021, while multi-family starts improved +42% from 2020.

“Commercial and multi-family construction starts staged a strong rebound in 2021, despite the continued impact of the COVID-19 pandemic,” said Richard Branch, chief economist for Dodge Construction Network, in the press release. “This recovery, however, has been fairly uneven with the focus on warehouse and multi-family activity, while office and hotel construction remain more constrained by the pandemic. Looking ahead, 2022 should bring with it a more even recovery spread across most commercial project types, while multi-family will continue to benefit from the high cost of single-family homes. While positivity abounds for the year ahead, be aware that high material prices and a shortage of skilled labor will prove to be limiting factors and will restrain overall growth.”

LOCAL MARKET INSIGHTS

New York. In the New York, metropolitan area, commercial and multi-family construction starts rose +14% in 2021 to $26.8 billion. Despite this strong gain, the level of activity is -13% below the level of construction starts in 2019. Multi-family starts were up +20% in 2021. The largest multi-family projects to break ground in 2021 were the $500-million 625 Fulton Street mixed-use project; the $349-million first phase of the Bronx Point mixed-use project; and the $300-million Islablue Apartments and Condominiums. In 2021, commercial starts rose +8%, led by gains in warehouses, retail, and parking while offices and hotels posted declines. The largest commercial projects to get underway in 2021 were the $1.5-billion JPMorgan Chase office tower; the $1.2-billion Terminal Warehouse conversion; and a $380-million Bronx Logistics Center.

Dallas. Commercial and multi-family starts in the Dallas metro area were up +45% in 2021 to $10.7 billion and surpassing the mark set during 2019, prior to the onset of the pandemic. Commercial starts rose +41% during the year with only the retail sector losing ground. The largest commercial projects started in 2021 were the $550-million second phase of the Lowes Hotel and Convention Center; the $175-million Granite Park Six office tower; and the $150-million Hardwood No. 14 office tower. Multi-family starts were +52% higher in 2021. The largest multi-family projects to get underway in 2021 were the $250-million Maple Terrace residential building; the $120-million Hall Park D4 residential tower and the $100-million Urby residential tower.

Miami. In the Miami metropolitan area, commercial and multi-family construction starts rose +65% in 2021 to $8.4 billion. The dollar value of multi-family starts more than doubled in 2021, rising +104%. The largest multi-family projects to break ground in 2021 were the $1-billion 1 Southside Park mixed-use building, the $250-million Five Park condominiums and apartments; and the $206-million first phase of the Miami River mixed-use project. Commercial starts were +21% higher in 2021, led by gains in parking structures, hotels and retail. Office and warehouse starts were both lower in 2021. The largest commercial buildings to get started in 2021 were the $340-million Legacy Hotel; the $122-million second phase of the Bridge Point Commerce Center warehouse project; and the $75-million Boca Raton resort.

Washington, D.C. Washington, D.C.’s commercial and multi-family building starts fell 9% in 2021 to $8.4 billion, and they remain 29% below the mark set in 2019. Commercial starts in Washington, D.C., lost 18% due to pullbacks in office, retail and warehouse starts. Starts for parking structures and hotels, however, both posted a gain in 2021. The largest commercial projects to break ground in 2021 were the $450 million Sterling 144 MW EdgeCore data center, the $225 million Vantage data center and the $200 million 20 Massachusetts Ave. renovation project. Multi-family building starts rose 1% in 2021. The largest multi-family project to get underway in 2021 was the $267 million 1900 Crystal/1851 S. Bell South & North residences, the $230 million Mather Senior Living Community and the $174 million 4000 Wisconsin Ave. NW/Upton Place mixed-use project.

Boston. Commercial and multi-family starts in the Boston metropolitan area rose +16% in 2021 to $7.3 billion. Despite the strong gain, starts were still -12% shy of their pre-pandemic high in 2019. Multi-family starts were particularly robust during the year, increasing 29%. The largest multi-family projects to break ground in 2021 were the $200-million 60 Kilmarnock St. residential building; the $200-million DOT Block Residences; and the $165 -million Union Square/USQ residential tower. Commercial starts rose +5% in 2021, led by increases in warehouse and parking structure starts, while office, hotel and retail starts each fell. The largest commercial projects to break ground in 2021 were the $466-million North Andover Amazon distribution center; the $350-million Amazon Seaport Square office tower; and the $225-million 171 Dartmouth St. office building.

Los Angeles. Commercial and multi-family starts were down -12% in 2021 to $7.1 billion and were down -24% from the pre-pandemic peak in 2019. Commercial starts in Los Angeles were down -32% over the year — entirely due to the office and hotel sectors, which saw several large projects break ground in early 2020. Meanwhile, retail and warehouse starts increased. The largest commercial projects to get underway in 2021 were the $200-million Spectrum Terrace office campus; the $102-million OCSD headquarter project; and the $100-million Ovation Hollywood mixed-use building. Multi-family starts improved +6% in 2021. The largest multi-family projects to break ground were the $250-million 520 S. Mateo Arts District mixed-use, the $215 million Broad Block mixed-use building and the $125-million The Line at Burbank apartments.

Atlanta. Commercial and multi-family starts were up + 49% to $6.6 billion in 2021. Despite the gain, commercial and multi-family starts were still -9% below the level of starts in 2019. Multi-family starts rose +46% in 2021 thanks to large projects such as the $400-million 1018 West Peachtree apartments; the $300-million first phase of the High Street Atlanta mixed-use development; and the $175-million Hanover apartments. Commercial starts gained +52% in 2021, with all categories except for parking structures gaining ground over the year. The largest commercial projects to get underway in 2021 were the $271-million Signia Hilton Hotel at Georgia World Congress Center; the $202-million CDC Chamblee campus buildings; and the $100-million The Cubes at River Park warehouse building.

Seattle. Commercial and multi-family construction starts were +48% higher in 2021 at $6.2 billion and were -18% higher than in 2019. Commercial starts were up +44% in the office, warehouse and retail sectors, while hotel and parking posted declines. The largest commercial projects to get underway in 2021 were the $355-million Project Roxy distribution center; the $325-million Amazon Bellevue 600 Tower One; and the $27- million The Eight office building. Multi-family starts rose +51% in 2021 with the $150-million Google Campus development; the $131-million First Light mixed-use project; and the $113-million SkyGlass Tower apartments among the largest multi-family projects to break ground.

Phoenix. Commercial and multi-family starts were up +11% to $6 billion in 2021, up +48% from the pre-pandemic high set in 2019. Multi-family starts, however, fell -8% in 2021. The largest multi-family projects to get underway in 2021 were the $170-million Culdesac Tempe apartment building, the $91-million first phase of the Milhaus North apartments and the $87 million Skye on 6th apartments. Commercial starts moved 27% higher in 2021 due to increases in warehouse, retail and office starts, while hotel and parking structure starts fell. The largest commercial projects to break ground in 2021 were the $800 million first phase of the Facebook Eastmark Parkway data center campus, the $100-million first phase of The Cubes at Glendale warehouse project; and the $750-million NTT data center.

Houston. Commercial and multi-family building starts in Houston, TX, rose +5% in 2021 to $5.5 billion but were -37% lower than the level of activity before the pandemic in 2019. Commercial starts increased +4% in 2021 due to gains in warehouse, hotel and retail starts, while office and parking structures declined. The largest commercial projects to get underway in 2021 were the $135-million second phase of the Empire West Business Park; the $125-million 1550 on The Green office building; and the $70-million TGS Cedar Port warehouse. In 2021 multi-family starts rose +6% with the largest multi-family projects to get underway including the $89-million The Hawthorne condo tower, the $61-million West Dallas apartment building; and the $60 million Oleanders at Broadway residential building.FOR DIGITAL

New York. In the New York, metropolitan area, commercial and multi-family construction starts rose +14% in 2021 to $26.8 billion. Despite this strong gain, the level of activity is -13% below the level of construction starts in 2019. Multi-family starts were up +20% in 2021. The largest multi-family projects to break ground in 2021 were the $500-million 625 Fulton Street mixed-use project; the $349-million first phase of the Bronx Point mixed-use project; and the $300-million Islablue Apartments and Condominiums. In 2021, commercial starts rose +8%, led by gains in warehouses, retail, and parking while offices and hotels posted declines. The largest commercial projects to get underway in 2021 were the $1.5-billion JPMorgan Chase office tower; the $1.2-billion Terminal Warehouse conversion; and a $380-million Bronx Logistics Center.

Dallas. Commercial and multi-family starts in the Dallas metro area were up +45% in 2021 to $10.7 billion and surpassing the mark set during 2019, prior to the onset of the pandemic. Commercial starts rose +41% during the year with only the retail sector losing ground. The largest commercial projects started in 2021 were the $550-million second phase of the Lowes Hotel and Convention Center; the $175-million Granite Park Six office tower; and the $150-million Hardwood No. 14 office tower. Multi-family starts were +52% higher in 2021. The largest multi-family projects to get underway in 2021 were the $250-million Maple Terrace residential building; the $120-million Hall Park D4 residential tower and the $100-million Urby residential tower.

Miami. In the Miami metropolitan area, commercial and multi-family construction starts rose +65% in 2021 to $8.4 billion. The dollar value of multi-family starts more than doubled in 2021, rising +104%. The largest multi-family projects to break ground in 2021 were the $1-billion 1 Southside Park mixed-use building, the $250-million Five Park condominiums and apartments; and the $206-million first phase of the Miami River mixed-use project. Commercial starts were +21% higher in 2021, led by gains in parking structures, hotels and retail. Office and warehouse starts were both lower in 2021. The largest commercial buildings to get started in 2021 were the $340-million Legacy Hotel; the $122-million second phase of the Bridge Point Commerce Center warehouse project; and the $75-million Boca Raton resort.

Washington, D.C. Washington, D.C.’s commercial and multi-family building starts fell 9% in 2021 to $8.4 billion, and they remain 29% below the mark set in 2019. Commercial starts in Washington, D.C., lost 18% due to pullbacks in office, retail and warehouse starts. Starts for parking structures and hotels, however, both posted a gain in 2021. The largest commercial projects to break ground in 2021 were the $450 million Sterling 144 MW EdgeCore data center, the $225 million Vantage data center and the $200 million 20 Massachusetts Ave. renovation project. Multi-family building starts rose 1% in 2021. The largest multi-family project to get underway in 2021 was the $267 million 1900 Crystal/1851 S. Bell South & North residences, the $230 million Mather Senior Living Community and the $174 million 4000 Wisconsin Ave. NW/Upton Place mixed-use project.

Boston. Commercial and multi-family starts in the Boston metropolitan area rose +16% in 2021 to $7.3 billion. Despite the strong gain, starts were still -12% shy of their pre-pandemic high in 2019. Multi-family starts were particularly robust during the year, increasing 29%. The largest multi-family projects to break ground in 2021 were the $200-million 60 Kilmarnock St. residential building; the $200-million DOT Block Residences; and the $165 -million Union Square/USQ residential tower. Commercial starts rose +5% in 2021, led by increases in warehouse and parking structure starts, while office, hotel and retail starts each fell. The largest commercial projects to break ground in 2021 were the $466-million North Andover Amazon distribution center; the $350-million Amazon Seaport Square office tower; and the $225-million 171 Dartmouth St. office building.

Los Angeles. Commercial and multi-family starts were down -12% in 2021 to $7.1 billion and were down -24% from the pre-pandemic peak in 2019. Commercial starts in Los Angeles were down -32% over the year — entirely due to the office and hotel sectors, which saw several large projects break ground in early 2020. Meanwhile, retail and warehouse starts increased. The largest commercial projects to get underway in 2021 were the $200-million Spectrum Terrace office campus; the $102-million OCSD headquarter project; and the $100-million Ovation Hollywood mixed-use building. Multi-family starts improved +6% in 2021. The largest multi-family projects to break ground were the $250-million 520 S. Mateo Arts District mixed-use, the $215 million Broad Block mixed-use building and the $125-million The Line at Burbank apartments.

Atlanta. Commercial and multi-family starts were up + 49% to $6.6 billion in 2021. Despite the gain, commercial and multi-family starts were still -9% below the level of starts in 2019. Multi-family starts rose +46% in 2021 thanks to large projects such as the $400-million 1018 West Peachtree apartments; the $300-million first phase of the High Street Atlanta mixed-use development; and the $175-million Hanover apartments. Commercial starts gained +52% in 2021, with all categories except for parking structures gaining ground over the year. The largest commercial projects to get underway in 2021 were the $271-million Signia Hilton Hotel at Georgia World Congress Center; the $202-million CDC Chamblee campus buildings; and the $100-million The Cubes at River Park warehouse building.

Seattle. Commercial and multi-family construction starts were +48% higher in 2021 at $6.2 billion and were -18% higher than in 2019. Commercial starts were up +44% in the office, warehouse and retail sectors, while hotel and parking posted declines. The largest commercial projects to get underway in 2021 were the $355-million Project Roxy distribution center; the $325-million Amazon Bellevue 600 Tower One; and the $27- million The Eight office building. Multi-family starts rose +51% in 2021 with the $150-million Google Campus development; the $131-million First Light mixed-use project; and the $113-million SkyGlass Tower apartments among the largest multi-family projects to break ground.

Phoenix. Commercial and multi-family starts were up +11% to $6 billion in 2021, up +48% from the pre-pandemic high set in 2019. Multi-family starts, however, fell -8% in 2021. The largest multi-family projects to get underway in 2021 were the $170-million Culdesac Tempe apartment building, the $91-million first phase of the Milhaus North apartments and the $87 million Skye on 6th apartments. Commercial starts moved 27% higher in 2021 due to increases in warehouse, retail and office starts, while hotel and parking structure starts fell. The largest commercial projects to break ground in 2021 were the $800 million first phase of the Facebook Eastmark Parkway data center campus, the $100-million first phase of The Cubes at Glendale warehouse project; and the $750-million NTT data center.

Houston. Commercial and multi-family building starts in Houston, TX, rose +5% in 2021 to $5.5 billion but were -37% lower than the level of activity before the pandemic in 2019. Commercial starts increased +4% in 2021 due to gains in warehouse, hotel and retail starts, while office and parking structures declined. The largest commercial projects to get underway in 2021 were the $135-million second phase of the Empire West Business Park; the $125-million 1550 on The Green office building; and the $70-million TGS Cedar Port warehouse. In 2021 multi-family starts rose +6% with the largest multi-family projects to get underway including the $89-million The Hawthorne condo tower, the $61-million West Dallas apartment building; and the $60 million Oleanders at Broadway residential building.