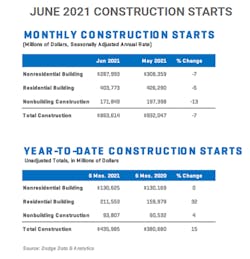

Total construction starts lost -7% in June, slipping to a seasonally adjusted annual rate of $863.6 billion, according to Dodge Data & Analytics. All three major sectors (residential, nonresidential building, and nonbuilding) pulled back during the month. Single-family housing starts are feeling the detrimental effects of rising materials prices. Large projects that broke ground in May were absent in June for nonresidential building and nonbuilding starts, resulting in declines.

“Unabated materials price inflation has driven a significant deceleration in single -family construction,” said Richard Branch, chief economist for Dodge Data & Analytics, in the press release. “Lumber futures have eased in recent weeks, but builders are unlikely to see much relief over the short-term, meaning building costs will continue to negatively influence the housing industry. On the other hand, the nascent recovery in nonresidential buildings has continued on as projects pile up in the planning stages. These mixed signals coming from both residential and nonresidential construction starts suggest that recovery from the pandemic will remain uneven in coming months as rising materials prices and labor shortages weigh on the industry.”

Nonresidential building starts. This category dropped -7% in June to a seasonally adjusted annual rate of $288 billion. Large healthcare and manufacturing projects provided a significant boost to May, but the absence of similar projects in June led to normalized starts activity. Without the negative influence of these sectors, nonresidential starts would have increased +10% in June. Commercial starts rose +12% with all categories posting gains, while institutional starts fell by -9% and manufacturing starts lost -62% over the month. Through the first six months of 2021, nonresidential building starts were slightly ahead of the first six months of 2020. Commercial starts were up +7% and manufacturing starts were +36% higher, while institutional starts were -5% lower through the first six months.

For the 12 months ending June 2021, nonresidential building starts were -14% lower than the 12 months ending June 2020. Commercial starts were down -18%, while institutional starts fell -10%. Manufacturing starts dropped -42% in the 12 months ending June 2021.

The largest nonresidential building projects to break ground in June were the $1-billion Research and Development District office project in San Diego; the $470-million second phase of the Oyster Point Offices in San Francisco; and the $410-million Amazon distribution center in Rochester, NY.

Residential building starts. Starts fell -5% in June to a seasonally adjusted annual rate of $403.8 billion. Single-family starts lost -8%, while multifamily starts were +2% higher. From January through June, total residential starts were +32% higher than the same period a year earlier. Single-family starts were up +37%, while multi-family starts were +19% higher.

For the 12 months ending June 2021, total residential starts were +22% higher than the 12 months ending June 2020. Single-family starts gained +29%, while multi-family starts were up +5% on a 12-month sum basis.

The largest multi-family structures to break ground in June were the $400-million Courthouse Commons project in San Diego, the $267-million 1900 Crystal Ave residences in Arlington, VA, and the $250-million Five Park Condominiums and Apartments in Miami Beach, FL.

Nonbuilding construction. This category lost -13% in June, dipping to a seasonally adjusted annual rate of $171.8 billion. While highway and bridge starts slid -7%, the overall decline in nonbuilding starts was the result of a -63% drop in the utility and gas plant category that followed a large increase in May. Total nonbuilding starts, excluding the utility/gas plant category, rose +3% on gains in environmental public works and miscellaneous nonbuilding. Total nonbuilding starts were up +4% within the first six months of 2021. Environmental public works surged +35%, while utility/gas plants gained +13%. Miscellaneous nonbuilding (-6%) and highway and bridge starts (-9%), however, dragged on the sector.

Dodge Data & Analytics said that for the 12 months ending June 2021, total nonbuilding starts were -6% lower than the 12 months ending June 2020. Environmental public works starts were +23% higher, while utility and gas plant starts were down -20%. Highway and bridge starts were down -3% and miscellaneous nonbuilding starts were -22% lower through the first six months.