NEMA’s EBCI Indexes for June Remain at the High End of Growth Territory

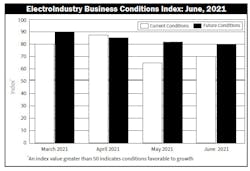

A slight improvement in confidence boosted the current conditions index from a reading of 65.4 points last month to 70 points in June. The share of panelists reporting better conditions increased, as did those indicating unchanged conditions. Concurrently, the number of respondents indicating worse conditions than in the prior month dropped to zero.

Although one comment regarding projects that were previously on hold and are now proceeding, was quite positive most reflected a bit of ambivalence, especially regarding the effects of supply chain challenges and inflationary pressures.

The ElectroIndustry Business Conditions Index (EBCI) is a monthly survey of senior executives at electrical manufacturers published by the National Electrical Manufacturers Association (NEMA), Rosslyn, VA. Any score over the 50-point level indicates a greater number of panelists see conditions improving than see them deteriorating.

Expectations for conditions six months ahead barely budged from last month’s reading, coming in at 80 points this month, compared to 80.8 points in May. This broad-based, sanguine view of conditions electrical manufacturers will likely face a few months from now was supported by comments expressing confidence that supply disruptions will be less prevalent and business activity will have begun moving to a “new normal.”

Some comments maintained an undercurrent of concern about the same matters currently dogging many producers: supply chain unreliability, labor shortages, and materials inflation.