Familiar Housing Hot Spots Lead Top 50 Metros for Building Permits in Early 2021

Electrical Marketing’s analysis of single-family building permit activity through the first four months of 2021 showed a dramatic increase over the past 12 months, with several familiar hot spots responsible for a big chunk of the growth.

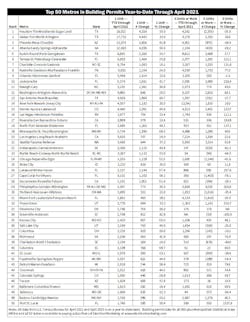

At 1,149 million permits issued year-to-date through April, single-family permits were up +71% over the 673,000 permits pulled year-to-date through April 2020, during the early days of the COVID-19 crisis. The five metropolitan statistical areas (MSAs) with the biggest increases in single-family permits so far this year over a comparable time period through April 2020 were Dallas-Fort Worth-Arlington, TX (+4,442); Houston-The Woodlands-Sugar Land, TX (+4,158); Atlanta-Sandy Springs-Alpharetta, GA (+4,036); Phoenix-Mesa-Chandler, AZ (+3,858); and Austin-Round Rock-Georgetown, TX (+2,280). Twenty-three MSAs had increases of at least 1,000 building permits year-over-year, with the bulk of these markets in Sunbelt states. Texas and Florida were notable for the number of metros showing big gains.

Other MSAs near the top of the list in single-family permit increases included San Antonio-New Braufels, TX (+1,864); Jacksonville, FL (+1,581); Tampa-St.Petersburg-Clearwater, FL (+1,404); Denver-Aurora-Lakewood, CO (+1,391); and Minneapolis-St. Paul-Bloomington, MN (+1,390).

Single-family construction activity over the past year has been quite consolidated, with the 57% of the permits pulled through April in the 50 MSAs listed in the chart below, and 72% of building permits in the 100 MSAs with the most permits.

Permits for multi-family housing with five units or more was also quite consolidated, with 15 MSA checking in with increases of more than 1,000 permits year-to-date over that same time period last year. The Philadelphia-Camden-Wilmington, PA-NJ-DE-MD MSA led all markets with an increase of 4,292 multi-family permits. Other MSAs scoring with big increases in multi-family construction so far this year were Washington-Arlington-Alexandria, DC-VA-MD-WV (+2,826); Austin-Round Rock-Georgetown, TX (+2,689); and Denver-Aurora-Lakeland, CO (+2,402).

According to data from Electrical Wholesaling magazine’s Market Planning Guide, the residential market typically accounts for between 15% and 20% of the average full-line distributor’s annual sales.