IHS Markit Sees Solid Recovery in 2021 for Global Markets as COVID Vaccines Kick In

Editor’s Note. The following commentary from one of IHS Markit’s leading economists on global economic growth provides a succinct snapshot of how countries around the world are working their way through the COVID-10 pandemic. It’s only available to subscribers to Electrical Marketing newsletter as part of a $99 annual subscription.

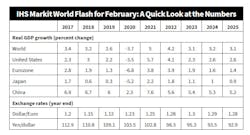

Global real GDP is projected to surpass its late-2019 peak in the third quarter of 2021, though economic recovery will vary widely across regions The Asia-Pacific region is leading the global recovery, as mainland China, Taiwan and Vietnam reached new peaks in the middle quarters of 2020, and India, Indonesia and South Korea will complete their recoveries this summer.

The U.S. economy is on track to reach a new peak in the second quarter of 2021. The Eurozone, Japan and Latin America will complete their recoveries in the second half of 2022. It will be mid-to-late 2023 before the United Kingdom, Italy, Spain, Nigeria,and South Africa regain pre-pandemic output levels.

Since cresting in January, new

COVID-19 virus infections have declined globally. Countries hit hardest by a winter wave of infections, including the United Kingdom, Spain United States and Russia, are seeing remarkable improvements. As activity restrictions are eased, consumer spending will revive, lifting global real GDP growth to a +5% annual rate quarter-on-quarter (q/q) in the second quarter. Businesses will gain confidence in the recovery’s durability and move forward with new investments.

IHS Markit expects the COVID-19 pandemic to recede during the rest of 2021 in response to the widening availability of vaccines, improved treatments and seasonal effects. By July, the world will reach an inflection point at which the most vulnerable populations are protected, mortality is reduced and hospitalizations are manageable. Nonpharmaceutical interventions will be less critical, meaning economies can reopen.

Annualized global economic growth is projected to average close to a +6% q/q rate in the final two quarters of 2021. Thus, after a +3.7% contraction in 2020, world real GDP will advance +5% in 2021 and +4.2% in 2022. Growth will settle to a more sustainable +3.1% pace in 2023.

United States real GDP is now projected to increase +5.7% in 2021, compared with a +4% advance in last month’s forecast. This revision reflects a better-than-expected performance in late 2020, a January surge in consumer spending, higher equity prices, declining COVID-19 virus infections, and new fiscal stimulus. The forecast incorporates major elements of the $1.9-trillion stimulus package now before Congress, including transfer payments to individuals and state and local governments, an extension of emergency unemployment programs and benefits, and funds for COVID-19 mitigation efforts.

With the economy now expected to reach full employment in the second quarter of 2022, the U.S. Federal Reserve is expected to begin raising its policy rate in mid-2024. Anticipation of earlier monetary tightening is already putting upward pressure on term yields.

The resurgence of COVID-19 and widespread lockdowns led to a second wave of recessions across most of Europe in late 2020 and early 2021. A consumer-led growth spurt is expected from spring 2021 as declining infection rates and vaccination programs facilitate a reopening of economies. Yet high debt burdens, adverse demographics, and weak productivity gains diminish long-term growth prospects. In Italy, the appointment of Mari Draghi as prime minister will help to stabilize the political situation.

Mainland China remains on track. New local outbreaks of the COVID-19 virus are mostly contained, although containment measures and softer consumer demand will lead to slower growth in the first quarter. After +7.6% real GDP growth in 2021, the economy will return to the deceleration path that began in 2012 as productivity growth slowed in response to stalled economic reforms.

Supply-chain disruptions throughout the pandemic are fueling price pressures. The IHS Markit Materials Price Index surged +53% year on year (y/y) in mid-February. Although some commodity prices will retreat as supply disruptions are resolved, IHS Markit analysts expect near-term accelerations in finished goods prices in the months ahead. If demand proves more resilient than anticipated once the pandemic subsides, inflationary pressures could intensify.

The bottom line. After stalling in the first quarter, the global economy should post solid growth during the remainder of 2021 and into 2022 as the COVID-19 pandemic subsides. — Sara Johnson, executive director, Global Economics, IHS Markit