Total Sales Through Electrical Distributors Slide -2.7% in 2021 to $105.5 Billion

Although electrical executives will have to factor in a fairly sizeable drop for total U.S. electrical sales through electrical distributors for last year, when you think of what we have all been through over the past 12 months, a -2.7% decrease on a national basis doesn’t seem all that bad.

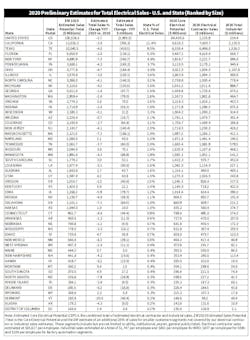

Electrical Marketing’s editors updated our 2020 sales potential estimates at the national, state and local (Metropolitan Statistical Area (MSA)), with the preliminary 2020 employment data for electrical contractors and industrials and Electrical Wholesaling’s 2020 sales-per-employees multipliers. Taken together, these two customer segments account for an estimated 75% of all sales through distributors. EM estimates that, on average, other smaller customers niches account for the remaining 25%, including electric utilities, institutional, export and retail sales.

While our estimate for a decline in sales on a national basis is comparatively tolerable, as you can see in the chart on page 2 and in the more detailed sales estimates available to Electrical Marketing subscribers by clicking here, some states fared much worse last year. Vermont’s estimated sales potential declined -20%, while other states with notable declines include North Dakota (-7.9%); Massachusetts (-7.3%); Oklahoma (-7.1%); and New York (-7%).

It’s tough to draw concrete conclusions for declines of this size. But there’s little doubt the impact of COVID-19 on construction projects in Massachusetts and New York had a big impact in these states, while the decline in oil & gas drilling activity hurt the energy-dependent economies of Oklahoma and North Dakota. According to EM’s estimates some states weathered the economic storm much better, including South Dakota (+4.9%); Idaho (+4.7%); and Utah (+4.2%).

When you analyze sales potential, it quickly become apparent just how consolidated sales are in the electrical wholesaling industry. When you take a look at the state data, you will find the 10 states with the most electrical potential account for a whopping 51% of all sales. These states are California (11.4%); Texas (9.5%); Florida (6.5%); New York (4.6%); Pennsylvania (3.7%); Ohio (3.6%); Illinois (3.4%); North Carolina (3.2%); Michigan (3%); and Georgia (2.9%).

On an MSA level, the Phoenix-Mesa-Scottsdale, AZ MSA always provides the most dramatic example of sales consolidation. EM’s preliminary 2020 annual data shows that last year the fast-growing metro accounted for 78% of Arizona’s $2.23 billion in total sales potential. The Denver-Aurora-Lakeland, CO MSA also accounts for a surprisingly large share of Colorado, with 59% of the state’s estimated $2.3 billion in estimated 2020 electrical sales.

Looking at a state’s share of national total potential or a local market’s share of a state is more than an interesting exercise for data nerds — it gives any electrical marketer basic insight into how their company’s market coverage lines up with the market share of a given geography. That type of information is helpful in determining branch performance, where to open a new location, or the performance of local reps, factory salespeople or distributors.

EM’s Feb. 26 issue will offer analysis of our preliminary sales estimates for more than 300 MSAs.

Download Electrical Marketing's 2020 Estimated Electrical Sales Potential at the state level by clicking here.