DISC Corp.’s Take on Today’s Electrical Economy — Bruised But Still Standing

Truly a black swan event of epic proportion is upon the entire world. The need for mandated social distancing measures has halted a large portion of the global economy. This is compounded by a contraction in oil prices deepened by a lack of demand. Massive layoffs and sharp contractions in financial markets are undermining personal wealth. Unprecedented drops in demand for goods and services may instigate the largest drop in domestic GDP ever.

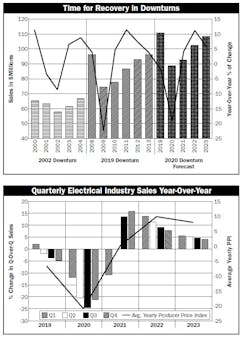

These events carry longer-lasting implications for recovery. That said, the electrical community is deemed, as it should be, an essential business. We have weathered downturns before and will again. The top chart below shows the downturn and recovery cycles of 2002 and 2009 as well as the current DISC forecast for this 2020 cycle. The bars in the charts below represent dollars of sales and the line is year-over-year (YOY) percentage of increase/decrease.

DISC’s base forecast for 2020-2023. The current forecast is to return to pre-pandemic levels by 2023 (equivalent sales dollars to 2019). The current but changing expectation for the overall electrical distribution market is to finish 2020 down -19.6% below 2019 year-over-year results. As stated in our last update, we expected further downward revisions as we continued to gather data. Our last forecast as of late March was -12.4% YOY.

As of now, the expectation for beginning the recovery cycle is in 2021 with a YOY increase of +3.9%. We are forecasting stronger acceleration in YOY growth of +11.4% in 2022. The 2023 forecast of +5.4% growth puts us in reach of 2019 sales.

Contractor. The revised Contractor Sector forecast is down -24.8% YOY for 2020 with the bulk of the downturn falling in 2020 Q3 and Q4, as construction markets tend to lag other markets. However, stay-at-home, social distancing and construction stoppages will heavily impact Q2 results, followed by steeper declines later this year and into the start of 2021. The forecast for 2021 is down overall -1%, followed by 2022 growth of +19.1%.

Industrial. The revised Industrial Sector forecast for 2020 is to be down -20.7%. Supply chain disruptions, factory closures and a drop in demand for goods and services due to illness and social distancing measures will continue to drag recovery through the year. We forecast a return to +5.7% growth in 2021 as government intervention with rate cuts and other aggressive fiscal policy measures start to positively impact the sector. In 2022, growth will climb to +6.3%.

Institutional. The revised Institutional Sector forecast is down -10.9% for 2020, with a return to growth of +6.9% in 2021 and +5.5% in 2022. A unique opportunity for construction in educational and other normally highly populated facilities currently exists, as closures allow for less restricted access to complete improvements and upgrades.

Utility. The revised Utility Sector forecast is down -9% in 2020, up +1.5% in 2021, followed by a +5.4% increase in 2022.

DISC’s current 2020 quarterly forecasts. The COVID-19 pandemic will continue to negatively and unpredictably pressure results through the balance of the year. Expect these forecasts to be revised in the weeks ahead. We currently anticipate a measured and slow market rebound beginning in 2021 with a return to positive results mid-year 2021 and recovery to pre-pandemic market levels in 2023.

If you need more current detailed information by sector, economic indicators, and the drivers of economic activity focused on the electrical distribution community, contact me about purchasing the DISC Monthly Flash report. My contact information (346) 339-7528/ [email protected] / www.disccorp.com.—Christian Sokoll, president, DISC Corp.

About the Author

Christian Sokoll

Chris began his career in the electrical industry 30 years ago in Spokane, WA, in the way so many in the electrical wholesaling space have – working the counter and the phones. He relocated to Phoenix, Arizona, and continued his career progression in an inside sales role with King Wire covering the Southwest. His next stop was Atlanta, where he continued to learn the business and worked the Southeast region. Little did Chris know that a move back to Washington state would start a career with Houston Wire & Cable that would span nearly three decades.

Chris was named “New Salesperson of the Year” in 1991 for his outstanding results and won additional awards for sales growth by supporting oil and gas exploration in the North Slope and managing a joint contract with Boeing. He progressed in his career taking an outside sales position in Lexington, KY, working with electrical distribution business development on major corporate accounts such as Mead Paper, DOW / Dupont, and the Savannah River Project. Chris was promoted to Regional Manager over the Southeast and again proved himself by significantly growing both sales and profitability.

Chris was asked to take on a turnaround project for Houston Wire & Cable’s Midwest Region, headquartered in the Chicago metro area, where he nearly tripled the region’s sales – from $24 million to $74 million. During his tenure in Chicago, Chris won numerous management and vendor awards for new product rollouts, sales growth, and national account management. His team won more “President’s Circle” sales awards than any of the other 11 Houston Wire & Cable locations. This high level of performance resulted in Chris earning a position as Regional Vice President.

Chris’s next stop was as Division President for Southern Wire, a heavy lift equipment wholesale subsidiary of Houston Wire & Cable based near Memphis, TN. He took this position post-acquisition and integrated the division, managed a transition of computer systems, and developed a segmented market plan while retaining all employees. Chris was able to buy out a competitor’s inventory, resulting in their exit from the market, and then hired their VP of Sales to step in as President of Southern Wire. This facilitated Chris’s next role as Corporate VP of National Business Development based in Houston, where his first responsibilities included continued oversight of Southern Wire, managing the Cable Management Services Project Group, and directing the National Service Center, a training and development group for new sales professionals entering the industry.

During this time overseeing so many critical divisions, Chris became more immersed in business intelligence and market data analysis – leading to innovative internal changes at Houston Wire & Cable. Chris learned to use and blend data from multiple sources such as DISCCORP, Industrial Information Resources (“IIR”), and ERP and CRM data to aid the company in embracing data and visualization tools in a completely new and unprecedented fashion. Chris deployed industry-leading corporate analytics and business intelligence tools such as Tableau, Power BI, Alteryx, Access, and Excel to inform and improve decisions and track KPIs. Likewise, he provided reporting for the board of directors and senior management team both in spreadsheets and in various advanced visual presentation formats. Chris also designed, tracked and approved compensation programs for sales reps and agents, and was also instrumental in the design and tracking of customer rebate programs.

In 2019, after working closely with DISC Corp. as a customer for five years and thus seeing the ongoing need for quality market intelligence data for the industry, Chris left Houston Wire & Cable to purchase DISC Corp. from its founder, Herm Isenstein. Along with being the leading economist in the electrical market for more than 30 years through his work at DISC, Herm was also a prolific author for Electrical Wholesaling magazine.

Herm passed away in Sept. 2019, but Chris continues to grow DISC’s vision while maintaining its leadership position as a trusted data source. By diligently working alongside DISC Corp.'s economists, programmers, and marketers, Chris embraces his passion to ensure that DISC continues delivering high-quality business intelligence and forecasting to further the future of the electrical wholesaling industry.

Chris holds a bachelor’s degree in organizational leadership from Roosevelt University in Chicago and a graduate certificate in finance from the University of Chicago. Chris has completed various Microsoft training programs in Excel and Access in addition to data science theory, and he has written college-level course material on Microsoft Power BI and Excel.