It’s still very early days in the electric vehicle market, but you can now see how Tesla’s competitors plan to bite into its commanding market share. Major car companies including Ford, GM and Honda plan to grab some of Tesla’s business by investing billions in facilities to build EVs in the United States. And you can’t overlook the spunky group of start-ups like Rivian, Lucent and Canoo that plan to make their mark by focusing on more tightly defined vehicle types, including luxury class (Lucent); delivery vans (Canoo); or SUVs/trucks (Rivian).

The market for EV charging equipment is more fragmented, with specialists like Blink, Chargepoint and Evgo competing against players from the mainstream electrical market like ABB, Eaton, Hubbell, LEDVANCE, Legrand, Schneider and Siemens.

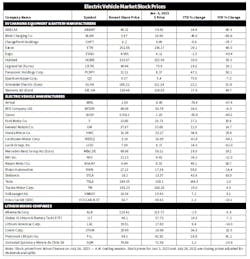

One way to gauge the financial health of different players is to track their stock prices if they are publicly held (see chart at bottom of page). Wall Street investors went ga-ga over the hyped-up launch of several of these EV manufacturers and EV battery companies during 2020-2021, driving up share prices to speculative heights. But the stock prices for several of these companies crashed. For example, Lucent got belted with an -87% decline from its high-water mark in Nov. 21; Rivian’s share prices plummeted -89% from its record high in Dec. 21; and QuantumScape, a developer of solid-state EV batteries, saw its share prices sail into the stratosphere in 2020 before suffering a decline over the past two years now approaching -90%.

While stock prices have bounced back in recent months for some EV players, few are beating the year-to-date performance of the tech-heavy NASDAQ, which at press-time was up +36% YTD and +17.4% YOY. Panasonic, which manufactures EV batteries, is pulling off this impressive feat, with a +47.1% YTD and +50.1% performance.

It’s interesting to note that although the publicly held electrical manufacturers that make EV chargers are not “pure-play” EV companies, their diversification may have helped them top the year-over-year performance of all three major stock indices.

One area of the EV market where stock prices in general aren't showing as much YOY growth is the lithium mining market, which produces a key metal for EV batteries. While Piedmont Lithium is enjoying a +42.5% YOY bump in its stock price over the past year, several of the other major lithium minors have seen their share prices decline over the past 12 months, including Albemarle Corp. (-4%); Sociedad Química y Minera de Chile SA

(-5.9%); and Lithium Americas Corp. (-14%). Even the popular ETF composed of lithium miners and EV battery companies, Global X Lithium & Battery Tech ETF, is down -7.2% YOY despite climbing +14.5% YTD.

While the explosive growth potential of many of these electric vehicles is undeniable, investors will need to keep their seatbelts fastened for what looks to be a wild ride over the next few years as this market sorts itself out.