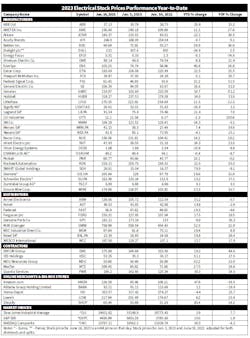

Although many economists believe the U.S. economy could slip into a recession in the second half of 2023, many publicly held electrical manufacturers, distributors and contractors are enjoying solid gains in their stock prices so far this year.

Hubbell’s year-over-year (YOY) returns are equally impressive and from June 30, 2022 to June 16, 2023 the stock is up +33%. Joining Hubbell at these lofty heights of YOY gains are EMCOR (+44.6%); Mersen (+39.6%); Atkore (+38.5%); Belden (+36.9%); Encore Wire (+33.7%); GE (+32%); Siemens (+31.9%); Federal Signal (+31.5%); and Rockwell Automation (+30.3%).

Few companies have seen their share prices decline significantly since the start of 2023. MDU Resources, a publicly owned utility with a large contracting business is down -32.2% and two lighting companies are lagging the field through June 16— Dialight with a -24.9% decline and Signify with a -16.9% decrease. Generac, a former Wall St. darling, has seen its share price cut in half since June 2022, but the company is clawing back some of that lost ground and is up +16.7% year-to-date.

Click here to download a spreadsheet of Electrical Marketing's Electrical Stock Index Mid-Year Review

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).