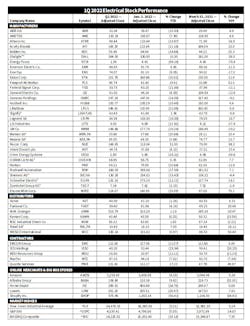

Electrical Stocks Get Whacked in 1Q 2022 with Many Shares Taking Large YTD Losses

The stocks of many publicly held electrical manufacturers, distributors slumped in Q1 2022, with many companies struggling to keep pace with key stock market indices. The Dow Jones Industrial Average was down -5.21% year-to-date (YTD) through March 31, while the S&P 500 lost -5.5% points YTD. The tech-heavy NASDAQ Composite got whacked with a -10.18% YTD decline through the first three months of 2022.

Over the past two years, most of the 40-plus stocks in the electrical manufacturing, distribution and contracting markets that Electrical Marketing tracks hammered these market indices. In 2021, 28 of these stocks beat the indices when comparing full-year performance to 2020. That’s not the case so far this year. Only 17 companies outperformed the Dow Jones, S&P and NASDAQ indices. Bolstered by big gains in steel and copper prices, Nucor (+31.5% YTD) and Freeport-McMoRan (+19.91% YTD) were leading all companies in Electrical Marketing’s Stock Index (see chart at the bottom of page).

Quanta Services (+17.23%), the national electrical contracting firm that specializes in the utility and renewables markets, and Dialight (+10.30%) were the only other companies with double-digit YTD gains. On the flip side, 23 stocks in the EM Stock Index are down, with Energy Focus (-69.16%); Orion Energy Systems (-26.32%); Pentair (-23.64%); and IES Holdings (-23.34%) off the most.

Interestingly, several big box retailers and online merchants suffered from larger 1Q 2022 share price declines than electrical stocks and traditional distributors. Shopify (-50.41%) was hit hardest, followed by Home Depot (-26.75%) and Lowe’s (-20.87%).