After years of slow growth, the U.S. offshore wind market is finally starting to take off, and several large-scale wind farms along the East Coast will start producing power on a grand scale over the next few years.

To date, much of the action in offshore wind has been in Europe, particularly off the coasts of England, Ireland, Scotland, France, Holland, Germany, Belgium, Denmark and Sweden. According to data at www.windeurope.org, “Europe now has a total installed offshore wind capacity of 18,499 MW being produced by 4,543 grid-connected wind turbines across 11 countries.” In 2018, 409 new offshore wind turbines were connected to the grid in 18 projects, according to the WindEurope trade group.

The impact on the U.S. electrical wholesaling industry is tricky to forecast, as much of the business is done directly with wind turbine manufacturers, manufacturers of submarine cable and other utility-scale electrical components, and the specialized construction companies that build offshore wind farms. The miles of submarine cable that account for a large chunk of the electrical spend in a wind farm is produced by a relative handful of wire and cable companies. ABB, Prysmian, Nexans, Sumitomo and Fujikura are some of the major players in this niche.

Sales opportunities may exist for companies that specialize in maintenance and replacement products for the turbines, or with the utilities and subsidiaries of utilities that will manage the grid interconnections to the offshore wind farms. There will also be a need for new electrical services at onshore staging areas near ports where the various components of the turbines and foundations are loaded onto specialized ships that transport them to the offshore wind farms.

Bruce Hammett, president and CEO of WECS Renewables, North Palm Springs, CA, has serviced the wind market for many years. He launched WECS in 1989 as a specialty distributor for the construction, operations and maintenance segments of the wind market, and over the years the company expanded into solar and energy storage.

Hammett and his team are watching the offshore wind market closely, and he believes there will eventually be opportunities in the maintenance of the offshore turbines, much as the WECS team services land-based wind farms. He says the turbines and other elements of most offshore wind farms are built to European specifications, but in this country once the power is brought to land, the utility generation products and distribution equipment are built and installed to U.S. specifications.

In an email to Electrical Marketing he said offshore wind turbines utilize many of the same technologies as land-based turbines, but on a much larger scale. “For offshore, we are investigating relationships overseas that might bring to us good partnering for components of all types. The technologies today are, from the electrical, mechanical and hydraulic perspectives, fairly mature and not unfamiliar to the turbines being installed on land,” he wrote.

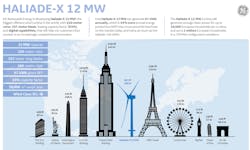

“The electrical capacity, and therefore the mechanical capacity are so much larger, on the order of potentially three times the size of land-based machines — 8MW to 10MW, with rotors approaching 200-meter diameters (approximately 656 feet). And the lifting capacities and methods are considerably different than on land, and the moving of generated electrical power from turbine to shore involve similar efforts to what’s seen on oil rigs and between islands.”

You will see some familiar names in the wind game, including GE Renewable Energy and Siemens (through Siemens Gamesa Renewable Energy (SGRE)). Both made headlines recently in the wind market because of their high-visibility contracts at new wind farms. Siemens sold 174 of its 7MW offshore turbines to for installation in the Hornsea One wind farm about 75 miles off of England’s eastern coast. When complete next year, Hornsea One will be the world’s largest wind farm and provide more than a gigawatt of power to 1 million homes, more than some traditional nuclear power plants.

The U.S. offshore wind industry got its start in New England, with the 30 MW Block Island Wind farm, which was commissioned in 2016. Environmental concerns slowed development of other offshore wind farms over the past few years, most notably the 800MW Vineyard One proposal off of the coast of Martha’s Vineyard, MA, but several projects either were announced or broke ground this year.

Dominion Energy recently began construction of the two-turbine, 12 MW Coastal Virginia Offshore Wind Project off the coast of Virginia Beach, VA. According to a post at www.dailypress.com, when completed in 2020, this wind farm will provide 3,000 homes with energy. Other big news this year in the U.S. offshore wind industry were projects off the coasts of New Jersey and New York. Ørsted’s 1,100MW Ocean Wind project off the coast of Atlantic City, NJ, will produce enough electricity to power 500,000 homes. Ørsted has quickly become a big name in the U.S. offshore wind market, and according to a recent company press release, it has a project pipeline with more than 8 gigawatts in seven states.

And in July, the state of New York announced its approval of two large farms off the coast of Long Island, NY — Equinor’s Empire Wind and Ørsted & Eversource’s Sunrise Wind development projects. According to a press release from Governor Cuomo’s office, when complete these wind farms will produce 1,700MW — enough to power more than 1 million homes. New York has also pledged $15 million to train workers for offshore wind jobs and develop port infrastructure, according to the same press release.

The American Wind Energy Association (AWEA) (www.awea.org) estimates the United States has more than 2,000GW in offshore wind potential, and that the offshore leases already negotiated have lots of potential. “There are currently 15 active commercial leases for offshore wind development in the U.S.,” said an AWEA post. “If these leases are fully built, there is the potential to support approximately 25GW of offshore wind capacity.”

Click on the green button below to see the offshore wind farms that are either underway or approved. Some proposed offshore wind farms of note are:

Vineyard Wind 1, Massachusetts: 800MW and 84 turbines; Vineyard Wind 2, Massachusetts: 400MW-800MW; Park City Wind, Connecticut: Up to 1,200MW; Bay State Wind, Massachusetts: Up to 800 MW, Ørsted and Eversource as developers; Dominion Energy's Coastal Virginia Offshore Wind Project, Virginia: Up to 2,000MW; US Wind: Maryland (250MW) and New Jersey (1,500MW).