EIA Energy Outlook: Continued Growth in Oil & Gas and Big Spike in Renewables Ahead

The U.S. Energy Information Administration (EIA) released its Annual Energy Outlook 2019 (AEO2019) on Jan. 24 and excerpts from its executive summary are presented below. It projects significant continued development of U.S. shale and tight oil and natural gas resources, as well as continued growth in use of renewable resources.

EIA’s Annual Energy Outlook is the Department of Energy’s largest resource for data on energy generation, consumption and new development. Executives working for electric utilities, oil and gas producers, renewable energy firms and companies in related industries use data from the Annual Energy Outlook to analyze trends in energy production and usage.

The report projects that in 2020, for the first time in almost 70 years, the United States will export more energy than it imports, and will remain a net energy exporter through 2050. U.S. energy export growth is driven largely by petroleum exports including crude oil and products, and by additional liquefied natural gas exports. These trends have become clearly established, and the report shows them continuing for the next few years, and then slowing and stabilizing.

“The United States has become the largest producer of crude oil in the world, and growth in domestic oil, natural gas, and renewable energy production is quickly establishing the United States as a strong global energy producer for the foreseeable future” said EIA Administrator Linda Capuano in the press release. “For example, the United States produced almost 11 million barrels per day of crude oil in 2018, exceeding our previous 1970 record of 9.6 million barrels.”

The EIA report also highlights the impact of sustained low natural gas prices and declining costs of renewables on the electricity generation fuel mix. Natural gas will maintain its leading share of electricity generation and continue to grow, increasing from 34% in 2018 to 39% in 2050. The renewables share, including hydro, also increases from 18% in 2018 to 31% in 2050, driven largely by growth in wind and solar generation.

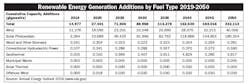

As you can see in the chart at the bottom of this page, EIA estimates that the addition of new solar resources will outpace the construction of new onshore wind facilities beginning in 2025. The report said, “In all cases, non-hydroelectric renewables consumption grows the most (on a percentage basis).

“Implementing policies at the state level (renewable portfolio standards) and at the federal level (production and investment tax credits) has encouraged the use of renewables. Growing renewable use has driven down the costs of renewables technologies (wind and solar photovoltaic), further supporting their expanding adoption by the electric power and buildings sectors.”

EIA’s Capuano said in the release that renewables will play an increasingly larger role in the U.S. energy mix over the next few years. “Solar and wind generation are driving much of the growth,” she said. “In fact, our (report) projects that renewables will grow to become a larger share of U.S. electric generation than nuclear and coal in less than a decade.”

Other significant findings include:

The United States will continue to see record high levels of oil and natural gas production. According to the report, U.S. crude oil production will continue to set annual records through the mid-2020s and remain greater than 14.0 million barrels per day (b/d) through 2040. Continuing development of tight oil and shale gas resources will support growth in natural gas and natural gas plant liquid (NGPL) production, which will reach 6 million b/d by 2030, as well as the growth in dry natural gas production.

Dry natural gas production will reach 43 trillion cubic feet by 2050. NGPLs grow faster than other fossil fuels, and account for almost one-third of cumulative U.S. liquids production during the projection to 2050.

U.S. net exports of natural gas will continue to grow, as liquefied natural gas becomes an increasingly significant export. The report says U.S. liquefied natural gas (LNG) exports and pipeline exports to Canada and to Mexico increase until 2030 and then remain fairly constant through 2050 as relatively low, stable natural gas prices make U.S. natural gas competitive in North American and global markets.

Increasing energy efficiency across end-use sectors will keep U.S. energy consumption relatively stable, even as the U.S. economy continues to expand. U.S. energy consumption grows across all major end-use sectors in the Reference case, with electricity and natural gas consumption growing fastest. The Annual Energy Outlook 2019 is available at https://www.eia.gov/outlooks/aeo.

—U.S. Energy Information Administration