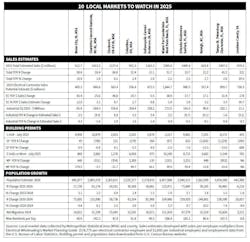

EM’s Picks for 10 Hot Growth Markets Offer Diverse Mix of Sales Opportunities

Most of Electrical Marketing's picks for this year have made our list of hot markets in the past because of impressive increases in both estimated sales potential and population growth. We also watch residential closely at the local level, but in many markets both single-family and multi-family building permits aren’t currently increasing at impressive levels.

Loudoun County

New to our picks (see chart below) is Loudoun County, VA, which enjoyed some huge growth in electrical contractor potential, thanks in large part to being home to the largest concentration of data centers in the United States. In addition to the $1.92-billion Realty LLC data center campus that entered the planning stages in April, 2025, there’s also a $500-million retrofit of Dulles Airport’s Concourse E on the drawing boards. Loudoun County’s estimated electrical contractor sales potential increased by $178 million YOY, according to EM’s estimates.

Cincinnati, Columbus and Indianapolis metros

We are also highlighting three Metropolitan Statistical Areas (MSAs) in the Midwest — Cincinnati, OH-KY-IN, MSA; Columbus, OH, MSA; and Indianapolis-Carmel-Anderson, IN, MSA.

The Cincinnati metro has a big hospital project in the pipeline, the $365-million Cincinnati Children’s Hospital in Liberty, OH. Columbus contractors are working on the $1.8-billion John Glenn Columbus Airport project that broke ground in Feb. 2025 and are hoping plans for billions in new construction become a reality, including Intel Corp.’s plan (recently delayed) for the $20-billion Johnstown Gateway Planned District near several semiconductor plants; a $500-million Amazon data center in Jefferson, OH; and Google’s $28-billion expansion project in New Albany, OH.

The Indianapolis metro is seeing a nice mix of commercial, institutional and industrial construction. The largest construction project underway that EM’s editors found is the $2.25-billion Eli Lilly Medicine Foundry in Lebanon, IN, an Indianapolis suburb. Also of note are the $571-million Signia Hotel project underway in Indianapolis and the $187-million Purdue University Academic Success Building being built in West Lafayette, IN.

Boise, ID

The Boise, ID, MSA, caught the eye of EM’s editors because of its growth over the past year in estimated total sales potential, electrical contractor sales and industrial sales potential. EM estimates that its 2025 total electrical sales potential grew $58.6 million to $612.7 million, a solid +10.6% increase supported in large part by a $43.4-million increase (+12%) in contractor sales potential.

The largest construction project underway in the Boise area is a new 1.2 million-sq-ft Micron plant, which according to www.wscarpenters.org is worth $15 billion in total construction value and will employ 2,000 workers at its expected 2026 opening date.

The area continues to attract new residents in big way, with the population of the area growing by 75,605 between 2020 and 2024. That averages out to an estimated 41 new residents per day.

Charlotte-Concord-Gastonia, NC-SC & Raleigh, NC

North Carolina has for years been a top growth market, and these two MSAs are often powering a big chunk of the construction activity and population growth. The state was also recently recognized as 2025’s #1 State for Business by CNBC.

Although both metros are seeing increases in contractor sales potential at just over the national level percentage of roughly +2%, big construction projects in the pipeline; a double-digit YOY increase in Raleigh’s multi-family building permits; and the always impressive population growth in both cities made these metros Top 10 picks. The Charlotte metro has several big data center projects in the proposal stage, including a $10-billion Amazon data center and AI campus in Hamlet, NC. A large industrial project of note is the $380-million PPG factory under consideration in Shelby, NC. Charlotte has also seen massive population growth over the past four years, according to U.S. Census Bureau data. The metro’s population increased by 215,006 residents from 2020-2024.

Raleigh is also seeing big-time population growth, with an increase of 144,861 from 2020-2024 for an estimated 86 new residents each day. Through July 2025, the metro was one of the few MSAs in the nation seeing a double-digit increase in multi-family building permits with a +13.8% year-to-date increase to 3,682 permits. No doubt some of these new residents will eventually be moving into two new multi-family projects now under construction — the $200-million Strand mixed-use project with 362 units and the $200-million Highline Glenwood residential tower that will top out at 37 stories.

Miami, Orlando & Tampa-St. Petersburg

It was tough to not include perennial high-growth Florida metros like Jacksonville, Sarasota and Fort Myers-Cape Coral in this year’s picks, but Miami, Orlando and Tampa-St. Petersburg just had too many construction projects underway and in the pipeline to ignore. Miami had five multi-family projects topping $200 million in total contract value as well as a $600-million airport project and eye-popping numbers of new residents moving into the area — 324,486 from 2020-2024 and an estimated 307 new folks coming into town every day. The Orlando area has plenty of stadium, airport and resort construction in the pipeline to keep contractors busy for a long time, as well as stellar population growth numbers. And the Tampa-St. Petersburg metro has a $1.5-billion airport project underway; a ton of downtown construction; and an estimated 148 new residents moving in each day.