Industrial Sales Potential Stay Sluggish in Most MSAs According to Latest EM Estimates

While mega-projects like semiconductor plants or EV battery factories are still in the headlines, overall industrial sales potential hasn’t grown much over the past year, according to Electrical Marketing’s latest sales estimates. EM estimates the industrial sales potential at the national level grew +0.7% year-over-year (YOY) in 2Q 2025 to roughly $34 billion.

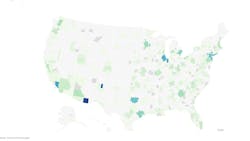

EM’s sales potential estimates are developed with a $2,650 sales-per-employee multiplier from Electrical Wholesaling’s Market Planning Guide and a three-month average for April 2025-June 2025 construction employment data from the U.S Bureau of Labor Statistics (BLS). The map below offers sales potential for more than 300 Metropolitan Statistical Areas (MSAs) and all 50 states. The data can also be downloaded through the link below.

FIVE LARGEST MARKETS

The five largest local industrial markets in the United States, when measured by Electrical Marketing’s sales potential data, all logged YOY decreases. Los Angeles-Long Beach-Anaheim, CA Metropolitan Statistical Area (MSA), with an estimated $1.2 billion in industrial sales potential, was down the most at -3.8% YOY and a drop of -$47.3 million in revenue potential, followed by the nation’s other billion-dollar industrial market, the Chicago-Naperville-Elgin (IL-IN-WI) MSA, with $1.1 billion in estimated sales and a -0.8% YOY decrease (-$8.6 million) in potential. Other MSAs in the Top 5 metros – the New York-Newark-Jersey City, NY-NJ-PA MSA (-0.2% YOY); Dallas-Fort Worth-Arlington, TX MSA (-0.7% YOY); Detroit-Warren-Dearborn, MI, MSA (-1.5% YOY) — also showed marginal declines.

Three Midwestern markets showed the largest dollar increases in industrial sales potential — Cleveland-Elyria, OH, MSA (+$15.5 million); Minneapolis-St. Paul-Bloomington (MN-WI), MSA (+$7.2 million); and Cincinnati (OH-KY-IN), MSA, (+$6 million). The Cleveland market’s increase isn’t exactly apples-to-apples with the other metros because the most recent BLS industrial employment data for it is from Dec. 2024, not 2Q 2025 as with most of the other metros and states in Electrical Marketing’s updated industrial sales potential data.

Several MSAs had some rather notable YOY declines in estimated industrial sales potential: the San Francisco-Oakland-Hayward, CA, MSA (-$24.8 million); New Haven, CT MSA (-$23.4 million); Worcester, MA, MSA (-$19.5 million); Seattle-Tacoma-Bellevue, WA (-$17.8 million); and Portland-Vancouver-Hillsboro (OR-ID) MSA (-$15.8 million).