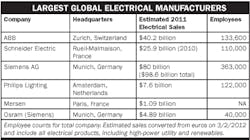

It’s financial reporting season, and when you click through the pages of glossy annual reports or 10-Ks of publicly held manufacturers of electrical equipment, you quickly realize that many of the very biggest companies are based outside the United States.

Indeed, the global electrical sales of ABB, Zurich Switzerland, ($40.2 billion); Schneider Electric, Rueil-Malmaison, France ($25.9 billion in 2010); Siemens, Munich, Germany ($80 billion); and Siemens’ lighting subsidiary Osram ($4.89 billion) dwarf the electrical sales of all but the very largest U.S.-based electrical manufacturers. With revenues on this scale, it’s easy to see how a company like ABB could afford to acquire two of the largest U.S. electrical manufacturers, Thomas & Betts Corp., Memphis, Tenn. (2011 sales of $2.3 billion) and Baldor Electric., Fort Smith, Ark. (estimated sales of $1.5 billion before being bought), and still have more than $10 billion budgeted for future acquisitions through 2015.

Only 12 publicly held U.S. electrical manufacturers have annual sales of more than $1 billion, according to Electrical Marketing research. And with 2011 revenues of $4.3 billion according Forbes magazine, Southwire Inc., Carrollton, Ga., appears to be the only privately held U.S.-based electrical manufacturer with sales topping $1 billion. Other large privately held electrical equipment manufacturers based in the United States, according to data available in Dun & Bradstreet’s Million Dollar Directory include Panduit Corp., Tinley Park, Ill.; Leviton Manufacturing Co. Inc., Melville, N.Y.; Fluke Corp. (Danaher), Everett, Wash.; Lutron Electronics Co., Coopersburg, Pa.; Arlington Industries Inc., Scranton, Pa.; Ideal Industries, Sycamore, Ill.; and Klein Tools Inc., Lincolnshire, Ill.

Check out the chart on page 2 (below) for estimates of the U.S. electrical manufacturers with more than $1 billion in electrical product sales. Because it’s difficult to break out actual electrical sales with many companies, don’t use this data for a sales ranking of the largest electrical manufacturers. EM’s editors have published it here so readers can gain insight into the relative size of the largest global manufacturers, as compared to companies based in the United States. The data published here doesn’t represent brand preference or U.S. market share.

Acquisitions will continue. There seems to be little doubt that more U.S.-based electrical manufacturers will be acquisition targets over the next few years, as the global players look to increase their presence in the United States, and U.S. manufacturers look to grow overseas. In his presentation at this year’s National Electrical Manufacturers’ Representatives Association (NEMRA) Annual Conference, Kirk Hachigian, chairman, president and CEO of Cooper Industries, Houston, said his company has boosted its sales outside the United States to 39 percent over the past few years, in part through more than 40 acquisitions around world and in this country. With 2011 total annual sales of $5.4 billion, Cooper Industries is now one of the 10 largest manufacturers of electrical equipment in the United States.

Acquisitions will continue to play a huge role in the growth of U.S.-based electrical manufacturers. At an investors’ conference earlier this year, David Farr, chairman and CEO of Emerson Electric Co., said his company will continue to aggressively manage its portfolio of brands, and that since 2000 the company has acquired $6 billion in sales through the purchases of 70 companies. He said Emerson has also divested $2.5 billion of sales through the sale of 20 companies during the past 12 years. Over the years, Emerson has acquired a number of familiar electrical brands that it now markets through its Industrial Automation and Network Products divisions, which combined have $12 billion in annual sales. These brands include Appleton, ASCO, Chloride, Leroy-Somer, Liebert, McGill and O-Z/Gedney.

Much of the acquisition activity in the mainstream electrical wholesaling industry during the past decade has involved manufacturers of distribution equipment, wire and cable, conduit, fittings, boxes, industrial controls and other shelf-good items. But the lighting market will probably continue be one of the more active acquisition arenas in the next few years. LEDs are becoming a bigger part of the lighting systems that distributors and reps sell, and some of the gigantic Pacific Rim manufacturers of LED components, like Panasonic, Sharp and Toshiba, want to grow in the United States. Another major factor driving acquisitions in the lighting space is the move to the “total lighting solution,” where one manufacturer provides lamps, ballasts and lighting fixtures. It’s the strategy that Philips Lighting has employed over the past decade to gain the top position in the lighting market, as measured by global sales. The company now reportedly markets more than 40 brands of lighting equipment.