EMCOR, Quanta & Grainger Among Electrical Stocks Enjoying Terrific Two-Year Run

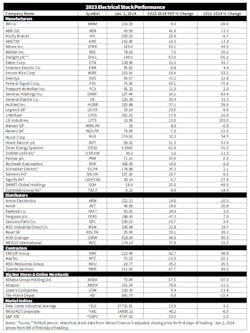

Shareholders of a nice-sized bunch of electrical stocks will one day be able to tell each other that 2022 to 2023 was the best of times. Share prices for 12 of the stocks that Electrical Marketing’s editors track for our Electrical Stock Index saw combined increases from 2022 to the end of 2023 of more than +30%, and 10 stocks living in the rarified air of a +40% increase over the past two years (see stock chart below). These stocks all smashed the performance of the S&P 500 (-1%); Dow Jones (+3.2%); and NASDAQ (-6.5%) during this time.

It’s particularly important to look at stock performance over the past two years instead of just looking at 2023 performance because the market has had drastically different results in 2022 and 2023. For instance, the S&P 500 was up +23.3% in 2023 after a -1% decline in 2023, and the NASDAQ was up +40.2% over the past year, but was down -6.5% in 2023. The S&P 500 is probably the closest representation as far as company mix to EM’s Electrical Stock Index, and depending on how far back you want to work its average returns over the years, it historical rate of return is between +8% and +10% (unadjusted for inflation). The NASDAQ’s annual historical return over its 51-year history is approximately +12.7% (not counting inflation) and the Dow Jones Index comes in at approximately+7.48% since 1928 (also not accounting for inflation.

That’s why the two-year performance of companies like Quanta (+88%); Federal Signal (+76.8%); EMCOR (+66.8%); W.W. Grainger (+60.5%); Hubbell (+58.6%); Nucor (+54.5%); nVent (+53.9%) and Encore Wire (+53.1%) is all the more impressive.

The stocks of publicly held electrical manufacturers, distributors and contractors were all equally represented on the list of top performers.

Unfortunately, not all publicly owned electrical manufacturers performed as well, and some well-respected companies saw their prices down double digits over the past two years, including Generac (-63.4%); Dialight (-56.2%); and 3M (-38%). Generac shares have been picking up recently, but the company’s stock has been hit hard after several years of spectacular returns. Shares peaked in Oct. 2021 at $498.56 after running up +492% from March 2020, and even more from a long run under $60 per share over the previous decade.