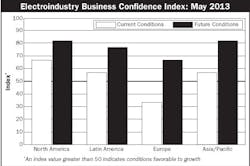

EBCI Index for Current Conditions Drops Sharply But Remains in Growth Territory

NEMA’s Electroindustry Business Confidence Index (EBCI) for current conditions in North America declined in May, falling from 66.7 points in April to 55.9 points, but continued to show signs of improvement in the business environment by remaining above the 50-point mark. The EBCI is a monthly survey of electrical manufacturers’ senior executives published by the National Electrical Manufacturers Association (NEMA), Rosslyn, Va. Any reading over 50 points indicates a growing business climate in the electrical market.

The share of respondents that reported conditions improved in May increased to 47.1% from 44.5% in April while 17.6% of respondents reported that conditions deteriorated, up from 11.1% in April.

The EBCI Global Indexes were mixed. The Latin American region showed a decline of 3.8% to 54.5 points for current conditions, but future conditions remained strong, with a 0.4% increase to 77.3 points. Europe’s current conditions increased 4.2 points to 37.5 points, still well under the growth threshold. Future conditions for the region declined 8.4 points to 58.3 points. The Asia/Pacific region was down 8.3 points for current conditions to 50 points, and down 1.6 points to 79.2 points for future conditions.