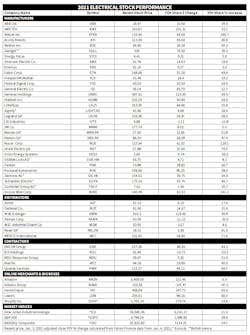

Electrical Stocks Crush Market Indices with Impressive 2021 YOY Share-Price Gains

Electrical stocks held up quite well in the turbulent 2021 stock market, with 28 of the publicly held electrical manufacturers, distributors and contractors beating the impressive year-over-year (YOY) growth numbers posted by the three major market indices in 2021: Dow Jones (+21% YOY); NASDAQ (+24.7%); and S&P 500 (+29.6%).

Leading the pack were three electrical manufacturers whose economic fortunes are closely tied to volatile steel and copper pricing. Atkore led all electrical manufacturers with a +160.7% annual gain, followed by Encore Wire Corp. (+142%); and Nucor Corp. (+117%).

Acuity Brands (+80.6%) rebounded nicely from a -12.8% annual decline in 2020, and its investors are enjoying a $91 increase in its share price over the past 12 months. Share prices of Generac stock, which saw annual share price gains topping +100% in both 2019 and 2020, cooled off substantially in 2021, but still had an impressive gain of +54.9% in 2021.

WESCO finished the year with a +71.6% price gain in its shares, which are now trading over the $130-per share mark. Rexel (+41.9%); Fastenal (+31.6%); and Grainger (+30.6%) also topped all of the market indices.

As a group, contractor stocks also did well in 2021. Quanta Services had an impressive year on Wall St. With shares near the $110 mark at press-time, investors are sitting on a +64.7% YOY gain. EMCOR (+43.1%) and MasTec (+40%) also had good years in the stock market.

A small handful of the stocks that Electrical Marketing’s editors track (see table below) saw share prices sink dramatically over the past year. Orion Energy Systems, a hybrid manufacturer and installer of energy-efficient lighting systems saw its share prices drop -60.2% YOY. IES Holdings, a publicly held electrical contractor also saw its share prices drop -23.1% over the past year to $3.80 through Jan. 3

With the Federal Reserve Bank looking to increase interest rates and to taper its purchases of government-backed bonds, few stock analysts expect the major market indices to top their 2021 performance in 2022. However, if the S&P 500 Index, Dow Jones and NASDAQ can top their average annual gains over the past 50 years of approximately +9.4%, +8.9% and +13.4%, respectively, it’s a reasonable bet that investors in electrical stocks will still be smiling at year-end.