Although the stocks of many publicly held electrical manufacturers, distributors and contractors outperformed the stock market indices in 2021 and 2020, the double-digit annual declines in prices that many stocks suffered last year was a painful reminder that the market giveth, and the market taketh.

In 2021 and 2020, it wasn’t at all unusual for many companies to enjoy annual increases in their stock prices of 20% to 30%. When the post-Covid euphoria subsided at the end of 2021, many companies gave back a good chunk of the gains they enjoyed, and during 2022 those double-digit gains turned into double-digit losses.

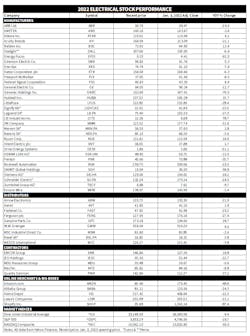

Manufacturers. After enjoying a 2021 YOY increase of nearly +47% as a group, the stocks of electrical manufacturers in total were down -13.7% in 2022. That performance was still better than the annual YOY tally for the S&P 500 (-19.7%) and NASDAQ (-33.3%), but it was still a bigger drop than the Dow Jones Industrial Average, which ended 2022 with a -9.4% YOY decline.

Only nine of the 33 publicly held electrical manufacturers registered YOY gains in their 2022 stock prices. LSI Industries led the pack with an impressive +79.7% gain, followed by Nucor (+16.6%); Hubbell (+15.7%); and Belden (+12.4%).

Unfortunately, most of the stock news with manufacturers was on the negative side of the ledger, as 17 companies had double-digit YOY declines and 14 companies did not beat the group’s performance average. Of the larger publicly held electrical manufacturers, Generac got hit hardest with an annual decline of -70.5%, and several other well-known companies suffered YOY losses of -20% or worse — Pentair (-35.7%); 3M (-31.6%); Littelfuse (-29.4%); Legrand (-27%); Schneider (-24.5%); Signify (-23.5%); Acuity (-21.1%); and ABB (-20%). Illustrating the often-fickle nature of the stock market, several blue-chip electrical stocks that enjoyed stratospheric gains per share prices over the past few years got hit the hardest – Generac, Acuity and Littelfuse.

Distributors. With a -3.9% YOY drop, distributor stock prices outpaced electrical manufacturers’ stocks, as well as the three market indices. There was quite a range of results for the stocks of publicly held distributor stocks, ranging from a +28.7% increase for Genuine Parts Co. to a -27.4% YOY decrease for Ferguson plc. WW Grainger saw its share prices increase +9.5% during 2022, as did Rexel SA, which registered a +3.9% increase.

Contractors. Contractor stocks were slightly positive with a +0.4% YOY gain. Quanta Services (+27.2%) and EMCOR (+16.9%) had impressive increases despite the adverse market conditions. IES Holdings saw the biggest decline with a -32.7% decrease.

Summary. Market activity in recent weeks is positive. When measured by percent change in the 50-day moving average, the stocks of publicly held electrical manufacturers as a group are up +6.4%, and the 50-day moving average for distributors’ stocks is up +3.6%. Contractors’ stocks reflected this positive trend, as this group of stocks’ 50-day moving average was up +4%. EM will publish its 1Q 2023 stock analysis in its first issue of April 2023.

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).