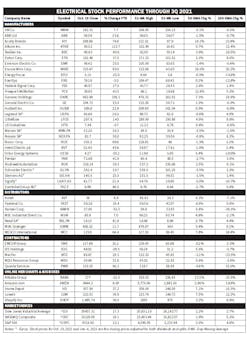

Despite concerns about inflationary increases in steel, copper and other basic materials, port delays and a sluggish recovery from COVID-19, the electrical stocks that Electrical Marketing tracks (see chart below) did surprisingly well in 3Q 2021.

On Oct. 19, more than 20 of the electrical manufacturers, distributors and contractors were tracking better year-to-date (YTD) than all three market indices — the S&P 500 (+22.1%), NASDAQ (+19.1%) and Dow Jones (+17.3%), which themselves are all comfortably beating their average annual increases over the past 40 years.

This quarter’s market leaders were an interesting mix. At the top of the list is Atkore, with a +113.7% increase YTD, followed by Generac (+106%); Nucor (+98.6%); Encore Wire (+89%); and Acuity Brands (+76.8%). Atkore and Nucor appear to be successfully navigating the treacherous volatility in steel prices this year, while Encore Wire appears to be doing the same with copper prices.

Generac has had an amazing run. Its share price remained in the $45 to $50 range from 2017 to early 2019 before making a spectacular +800% total gain to its current level of over $460 per share. Acuity Brands also has an interesting chart over the past few years. Historically, the company has often been one of the leaders of the electrical pack in annual share price growth. However, it hit a rough patch last year when its share prices lost approximately -56% from a high of around $172 per share to a low of approximately $76 per share in March 2020. Since that bottom the stock has gone on an impressive +175% run.

Two other stocks that have separated themselves from the pack in YTD share growth are Quanta Services, with a +66.2% increase to $113.25 per share, and WESCO, with a +64% increase to $125.90 per share.