Details on the Biden Administration plans for an infrastructure bill began to emerge this week, and it looks like the funding in the bill, if passed by Congress, would create major sales opportunities for a broad array of electrical products.

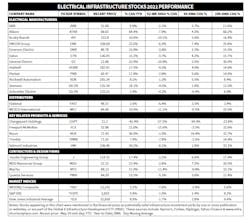

Wall Street analysts and at least one ETF investment fund believe the publicly held electrical manufacturers, distributors, contractors and design firms, as well as manufacturers of related products and services in the chart at the bottom of this post, would benefit from the infrastructure spending in Biden’s plan if it’s passed by Congress.

The stocks appearing in this chart were mentioned in the financial press as potentially solid infrastructure investment picks by one or more publication or websites; were part of the Global X Infrastructure Development ETF (PAVE); or were selected by EM’s editors as electrical manufacturers with the most diverse product offerings that would be logical beneficiaries of an infrastructure bill. It’s interesting to note that Nucor (NUE), a manufacturer of steel conduit and related products, and Valmont Industries (VI), a manufacturer of utility poles and area lighting poles and equipment have enjoyed the biggest year-to-date increases in their share prices, with both up more than +30% through March 24.

According to a March 23 article in the New York Times, the bill could include as much as $3 trillion in infrastructure spending in total, and could include spending on rural broadband, affordable and energy-efficient housing units and “nearly $1 trillion in spending on the construction of roads, bridges, rail lines, ports, electric-vehicle charging stations, and improvements to the electric grid and other parts of the power sector.”

With such a broad scope, there’s little doubt companies of all sizes and not just the publicly held companies in the chart would potentially see some sales opportunities created by this federal cash infusion for infrastructure projects. Certainly, wire and cable manufacturers, utility product companies and others that manufacture products for the national electrical grid or broadband networks would benefit, as would manufacturers of electric-vehicle (EV) charging stations, distribution equipment and switchgear and commercial lighting equipment.

Because of their existing focus on infrastructure work, EV charging stations and renewables, the market’s electrical conglomerates — ABB, Eaton, Schneider Electric and Siemens — would be nicely positioned as beneficiaries of any bill. Barbara Humpton, president and CEO, Siemens USA, has been particularly vocal about her company’s intentions in the infrastructure arena, and last month penned a letter to President Biden on the need for investment in mass transit, electric vehicle charging stations, the power grid, microgrids and smart buildings. Her communique was widely covered on CNBC and other financial news outlets.

Her letter said in part, “This moment clearly calls for new partnerships between the public and private sectors. Traditionally, governments provide the funding; companies do the building. Let’s see this as a moment to work together to solve problems and spark new innovation.”

Although EV charging stations are only one market segment that would be influenced by the Biden Administration’s infrastructure spending plans, the fact that a nationwide network of EV chargers is being discussed is intriguing because of the potential sales opportunities for so many electrical manufacturers, distributors, reps, electrical contractors, design firms and other electrical players. Some pure-play EV charging companies to watch may be Chargepoint Holdings (CHPT), and Electrify America, a wholly owned subsidiary of Volkswagon Group of America. They have a partnership in place to build tens of thousands of DC fast-chargers across the United States.