NEMA’s EBCI Index for August Strikes More Positive Note on Market Conditions

Oct. 6, 2022

2 min read

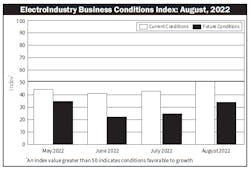

Following three months of downbeat readings on business conditions facing the electroindustry, as measured by the current conditions component of the EBCI, sentiment reached 50 points, signaling unchanged conditions from the previous month. The more than six-point gain from July’s 43.8 points was led by an uptick in the share of respondents that reported “better” conditions in August. Comments indicated that some respondents have seen pockets of growth in an otherwise slowing economy. In a striking change from comments submitted over the past 15 months, the only mention of supply problems in August’s current conditions commentary pointed to “minimal improvement in supply chain issues.”

The ElectroIndustry Business Conditions Index (EBCI) is a monthly survey of senior executives at electrical manufacturers published by the National Electrical Manufacturers Association (NEMA), Rosslyn, VA. Any score over the 50-point level indicates a greater number of panelists see conditions improving than see them deteriorating.

Despite gaining nearly 10 points to a reading of 34.6 points in August, the future conditions component remained well underwater for the sixth consecutive month. Comments were mixed on the likelihood of continued momentum, but expectations for supply chain and labor market improvement, coupled with still-significant orders backlogs, supported the bump up in the forward-looking metric.