50 Metros Account for More Than 50% of Total Electrical Sales Potential in 1Q 2022

Although many electrical distributors are forecasting some sizeable revenue increases for 2022 fueled at least in part by inflation, Electrical Marketing’s electrical sales forecasts showed some potential softening in local market conditions compared to late 2021.

In Electrical Wholesaling’s recent survey for its 2022 Top 150 ranking, 46% of respondents were expecting a 2022 sales increase of more than +15% — roughly double the high end of the industry’s average annual range of sales increases (+4% to +8%). While it’s tough to know where inflation and electrical price increases will settle in by year-end, Electrical Marketing’s Electrical Price Index as a whole is up +18.4% for the year.

One reason for caution are the employment declines EM editors spotted over the past few months in the key electrical contractor and industrial market segments. According to 1Q 2022 employment data (3-month average) published by the U.S. Bureau of Labor Statistics (BLS), estimated U.S. electrical contractor employment is down -3.5% from 4Q 2021 to 947,700 and U.S. industrial employment is down -2.9% over that same period to 12,574,667 employees.

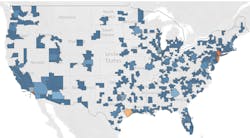

Electrical Marketing used this BLS employment data in tandem with Electrical Wholesaling’s sales-per-employee multipliers ($73,268 per electrical contractor employee and $2,006 per industrial employee) to calculate the 1Q 2022 estimated electrical sales potential by Metropolitan Statistical Area (MSA) and at the bottom of this page lists the 50 MSAs with the most total, electrical contractor and industrial sales potential. Click here to download the data for all 50 states and more than 300 market areas.

You might be surprised by the consolidated nature of U.S. electrical sales. Twenty five of these MSAs offer at least $1 billion in total electrical sales potential. Of the $118.3 billion in total electrical sales potential, the 10 largest MSAs account for 23% of all sales — New York-Newark-Jersey City, NY-NJ-PA; Los Angeles-Long Beach-Anaheim, CA; Dallas-Fort Worth-Arlington, TX; Houston-The Woodlands-Sugarland, TX; Chicago-Naperville-Elgin, IL-IN-WI; Washington-Arlington-Alexandria, DC-VA-MD-WV; Phoenix-Mesa-Scottsdale, AZ; Atlanta-Sandy Springs-Roswell, GA, Seattle-Tacoma-Bellevue, WA; and Miami-Fort Lauderdale-West Palm Beach, FL. The 50 largest MSAs offer $63.7 billion in total estimated electrical sales potential. EM’s editors estimate that’s approximately 54% of all sales in the electrical industry.