Mid-Year Check on Electrical Stocks Reveal Mixed Share Prices with Some Stellar Returns

Industry stocks are reflecting some broad trends in the overall stock market, where a handful of companies are turning in some eye-popping returns in their year-to-date (YTD) and year-over-year (YOY) share prices; other companies are struggling with big declines; and most companies clustered somewhere around the industry averages.

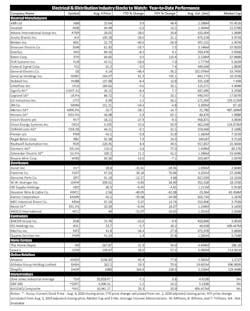

Consider the share prices of the 29 electrical manufacturers tracked by EM’s editors (see chart at the bottom of the page). As a group, the stocks averaged a -6.3% decline since 2020’s market opening on Jan. 2. However, three stocks are enjoying double-digit YTD gains: Generac (+61.3%); Orion Energy Systems (+23.6%); and Schneider Electric (+11.2%). Nineteen stocks had share declines, and of those stocks, 10 were down more than -10%.

Perhaps reflecting the volatility of the overall stock market in 2020, the YOY stock price changes for electrical manufacturers tell a different story. Seventeen stocks have double-digit stock increases since Aug. 5, 2019, led by Generac with a spectacular +135.1% return, and Eaton Corp., with an equally impressive +110.4% YOY increase. On the flip side, several electrical manufacturers are currently saddled with double-digit declines on both a YTD and YOY basis — GE, Belden, Acuity Brands and Mersen SA. Down -48.4% and -36.2%, YTD and YOY, respectively, GE and Belden were lagging the pack.

As a group, the share prices of publicly held distributors were weaker than those of electrical manufacturers, with a -14.5% decline YTD. Fastenal was the only distribution stock with a YTD increase, with its flashy +30.2% gain in share price so far this year.

When measured on a YOY basis, distributors’ +2.6% increase YOY lagged all of the overall market indices — the Dow Jones Industrial Average (+3.8%); S&P 500 (+14.2%); and NASDAQ (+20.9%). However, overall the news for publicly held distributors was much better with the YOY data, with five of the distributors EM tracks showing gains, andwith this time with a gaudy +70.7% YOY gain.

The share price returns logged in this year by alternate channels for electrical supplies were much higher than most of the traditional distributors. Home Depot (+21.9%) and Lowe’s (+26%) showed strong growth on a YTD basis, and even better growth when measured on a YOY basis where Home Depot produced a return of +34% and Lowe’s topped that with a +57.2% return.

If you follow the stock market at all, you know all about the spectacular growth of Amazon. Its share prices are up +65.4% YTD and +77.8% YOY. While Alibaba and Shopify haven’t yet focused on electrical product sales, they also turned in strong performances. Shopify shares were up +164.8% YTD.

The stock market is never an accurate reflection of overall economic conditions, and in 2020, share prices for many companies seem totally uncoupled for economic realities. But they are still an interesting indicator for shareholder confidence in companies to produce profitable investments for them.