IHS Markit Sees Short but Painful Recession for World Economy Ending in 3Q 2020

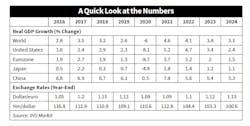

All signs point to the second-quarter real GDP plunge in the US and European economies being one for the records — with double-digit quarter-on-quarter declines in the United States, eurozone and United Kingdom. Anticipating that growth will return in the third quarter in the American and European economies, these downturns will still be the worst since the end of World War II. For 2020 as whole, real GDP is projected to fall -8.1% in the US, -8.7% in the eurozone and -12.2% in the UK. Mainland China’s record first-quarter nosedive has been followed by a second-quarter rebound, which will lead to annual growth of 0.5%. All this means that global real GDP is projected to decrease -6.% in 2020, more than three times the -1.7% contraction in 2009 during the global financial crisis.

Ironically (and mercifully), the recessions triggered by the 2019 COVID-19 coronavirus pandemic in the developed economies are likely to have been short. IHS Markit estimates that the recession lasted two months in the United States and eurozone (March and April) and three months in the United Kingdom (March, April and May). For the U.S. economy, this would be the shortest recession on record (back to the 1850s). The prior record for the shortest recession was the six-month-long downturn in 1980.

The intensity and quickness of the downturn are confirmed by the IHS Markit Purchasing Managers Index (PMI) reports for May. After unprecedented drops to record lows, PMI data for all the key economies have bounced back sharply. However, with the exception of China, the indexes are still below 50, the demarcation line between contraction and expansion. While the worst is over, the recovery is likely to be hard slog — even after an anticipated short-term bounce. The global index of manufacturing export orders remains deep in contraction territory, suggesting the external demand outlook of China and other Asian export powerhouses is highly challenging. IHS Markit predicts that global trade will contract at a double-digit rate in 2020.

Even with the beginnings of a recovery in place, the fallout from this pandemic and the lockdowns can only be described as massive. With millions of businesses shuttered and tens of millions of workers unemployed, the economic and social costs continue to rise and will stay elevated for a long time. This will require continued and additional support from central banks and governments and continued vigilance by health authorities vis-à-vis new waves of the COVID-19 virus. Otherwise, this deep and brief downturn could turn into something far worse.

— Nariman Behravesh, chief economist, IHS Markit; and Sara Johnson,executive director, global economics, IHS Markit