It’s been a rocky recovery for the construction market. An analysis by Associated General Contractors, Washington, D.C., of the latest construction employment figures from the Bureau of Labor Statistics shows construction employment declined in 156 out of 337 metropolitan statistical areas (MSAs) between Oct. 2011 and Oct. 2012, increased in 127 MSAs and was stagnant in 54 MSAs.

AGC said the MSAs with the largest job losses were Nassau-Suffolk, N.Y. (-5,600 jobs, -9%); Philadelphia (-5,400 jobs, -8%); Newark-Union, New Jersey-Penn. (-4,000 jobs, -11%) and Las Vegas-Paradise, Nev. (-4,000 jobs, -10%). Other areas experiencing large percentage declines in construction employment included Jackson, Miss. (-21%, -2,300 jobs), and Birmingham-Hoover, Ala. (-17%, -3,900 jobs).

The association’s analysis also showed that Pascagoula, Miss., added the highest percentage of new construction jobs YTY (29%, 1,400 jobs) followed by Haverhill-North Andover-Amesbury, Mass.-N.H. (18%, 700 jobs); Mobile, Ala., (18%, 1,900 jobs); and Chattanooga, Tenn. (17%, 1,500 jobs). Houston-Sugar Land-Baytown, Texas (17,400 jobs, 10%) added the most jobs. Other areas adding a large number of jobs included Seattle-Bellevue-Everett, Wash. (6,500 jobs,10%); Boston-Cambridge-Quincy, Mass. (6,300 jobs, 12%); Dallas-Plano-Irving, Texas (5,100 jobs, 5%) and Fort Worth-Arlington, Texas (5,100 jobs, 9%).

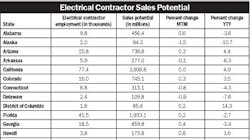

Any change in construction employment has a direct impact on the electrical market, because according to Electrical Wholesaling data, electrical contractors account for 13% of all construction employment, and the electricians they employ account for 9% of total construction employment. According to EW’s market-tested sales multipliers, each employee at an electrical contracting firm represents $46,585 in sales potential. Dramatic swings in employment can have a huge impact on the market potential. For instance, although EW estimates the market potential of electrical contractor sales for distributors on a national basis for October was approximately $34.7 billion, that figure was closer to $40 billion at the market’s peak in 2007. Check out the chart on this page for electrical contractor sales potential by state.

A report on the value of new construction spending in October by McGraw-Hill Construction pointed to the construction market’s rocky recovery. The company said the value of new construction starts retreated 14% in October to a seasonally adjusted annual rate of $434.9 billion. It’s not all bad news on the forecasting front. Although McGraw-Hill said nonresidential building decreased 4% in October to an annual rate of $131.6 billion, and that within that category office construction in October slipped 3%, several noteworthy office projects started up during the month: the $216 million Tower at PNC Plaza in Pittsburgh; the $110 million Energy Center III office tower in Houston; a $76 million municipal office building in Boston; and a $50 million headquarters renovation for TJX in Marlborough Mass.

The release also said hotel construction in October grew 7%, helped by the start of a $189 million hotel in Austin, Texas, and that store construction also registered a gain in October, rising 3% with the help of the $101 million retail portion of a $250 million residential/retail project in Brooklyn, N.Y.

On the institutional side, McGraw-Hill said the educational facilities category continued to lose momentum, dropping 3%, although a $95 million facility broke ground at the University of Tennessee in Knoxville, Tenn. The public buildings category posted a large October gain, climbing 92% due to the start of a $524 million military facility at Offutt Air Force Base in Nebraska.