Home Builders Concerned with Tariffs, But Some Hot Metros Will See Stellar Growth

Although U.S. single-family building permits saw some decent growth in 2024, with a +6.7% increase to 981,834, home builder are concerned about the impact of tariffs on many of the key building materials they install in homes. The National Association of Home Builders (NAHB) estimates that last year 7.3% of all building materials used in new residential construction were from a foreign country. In a recent NAHB/Wells Fargo Housing Market Index survey, home builders said new tariffs could add $9,200 to the cost of a new home.

Fortunately for home builders, softwood lumber from Canada and gypsum board from Mexico are so far exempt from any additional tariffs. NAHB says Canada accounts for roughly 85% of all U.S. softwood lumber imports and accounts for nearly a quarter of the available supply in the U.S. In an official statement to the media, NAHB Chairman Buddy Hughes said, “While the complexity of these reciprocal tariffs makes it hard to estimate the overall impact on housing, they will undoubtedly raise some construction costs. However, NAHB is pleased President Trump recognized the importance of critical construction inputs for housing and chose to continue current exemptions for Canadian and Mexican products, with a specific exemption for lumber from any new tariffs at this time.”

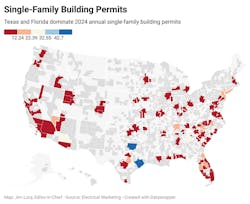

As has been the case for as long as Electrical Marketing has been analyzing building permit data, a relative handful of markets account for the lion’s share of the residential building permit activity.

In the 100 MSAs that logged the most building permits (see table on pages 3-4), about a dozen Intermountain and Sunbelt states accounted for most of the permits. Florida had 18 MSAs in the Top 100, followed by California (9); North Carolina (8); South Carolina (6); Texas (6); Georgia (4); Utah (4); Tennessee (4); Colorado (3); and Arizona (3). The Top 100 MSAs in the table accounted for 705,048 single-family permits; 72% of the total, while the Top 50 MSAs accounted for 56% of all single-family permits pulled in 2024. Top 10 accounted for 25%.

Although the residential market is responsible for only 15% to 20% of the typical electrical distributor’s sales according to Electrical Wholesaling data, it’s still a critically important market for the electrical industry, because new housing draws in all sorts of other commercial construction activity, including retail strip malls, big box stores and Main St. shops; hospitals and medical buildings; schools; and houses of worship. While the residential market will be in for a challenging year because of tariffs, the uncertain economy, and zoning restrictions for new development, it will continue to be one of the most important markets in the electrical construction industry.

Click on File Below to Download 2024 Annual Building Permits for All Metros & States

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).