Sunbelt Housing Markets Continue to Dominate Single-Family Building Permits

High mortgage rates are expected to continue snuffing out demand for new single-family homes for the foreseeable future. Although the rate for 30-year, fixed-rate mortgages is expected to drop below 7% in 2024 and will be reasonable compared to historical standards over the past 40 years, construction economists don’t expect any miracles in the housing market in 2024. Along with pricing out many first-time homebuyers, these rates have had a huge impact on the willingness of existing homeowners with low mortgage rates to sell and refinance at higher rates

The National Association of Home Builders (NAHB) expects single-family housing starts to increase +4.6% next year from 905,000 in 2023 to 946,000 in 2024. While the increase may cheer up some homebuilders and the electrical manufacturers, distributors and reps selling residential electrical products, this level of activity is relatively slow. In the healthiest of times in the housing market, single-family housing starts easily top 1 million per year and in 2005 topped out at 1.72 million starts.

Another factor to consider with the residential construction market is that the vast majority of the activity is in the southern and western regions of the United States. For instance, in 2022 57.8% of all single-family construction was in the South, followed by 23% in western states. The Northeast (6.3%) and Midwest (6.4%) saw comparatively little activity.

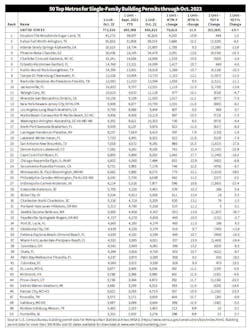

Building permits, a good leading indicator of future building activity because homebuilders don’t buy a permit unless they plan to build a home, tell a similar story. According to the year-to-date building permit data through Oct. 2023 from the U.S. Census Bureau, most single-family building permits were pulled in the southern and western states. Overall single-family construction activity on a national basis was down -10.7% through Oct. 2023, but a few of the biggest markets this year for single-family building permits (see chart on page 2) are seeing gains over last year. The exceptions are the nation’s top market in 2023 for single-family permits — the Houston-The Woodlands-Sugar Land, TX MSA, with a +1% increase to 43,270 permits; the Orlando-Kissimmee-Sanford, FL, MSA with 14,748 single-family permits so far (+4.6% year-to-date (YTD); and Los Angeles-Long Beach-Anaheim, CA MSA with 9,793 single-family permits (+3.7% YTD).

The five largest local markets for single-family building permits through Oct. 2023, are all perennially fast-growing Sunbelt markets: Dallas-Fort Worth-Arlington, TX MSA (35,826 permits); Atlanta-Sandy Springs-Alpharetta, GA MSA (20,519 permits); Phoenix-Mesa-Chandler, AZ MSA (20,436 permits); and Charlotte-Concord-Gastonia, NC-SC MSA (16,241 permits).

Click here to download Oct. 2023 building permit data for all MSAs and states

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).