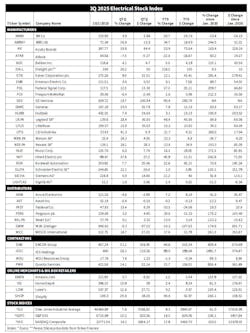

Electrical Marketing's 3Q 2025 Electrical Stock Index: Let the Good Times Roll

The stock market has been on a tear over the past few months, and many publicly held electrical manufacturers, distributors and contractors are enjoying the acceleration in their share prices. The S&P 500 Index was up roughly +10% in 3Q 2025 and approximately +14% year-to-date. More than 20 of the companies Electrical Marketing’s editors track for their Electrical Stock Index (see chart below) beat the S&P on a quarterly and year-to-date basis.

Interestingly, electrical contractors had some of the biggest increases in their share prices. IES Holdings (+38.1%); EMCOR (+31.1%); and Quanta Services (+14.1%) crushed the S&P 500 Index in 3Q 2025 and are also riding high year-to-date with IES Holdings up a whopping +99% year-to-date; EMCOR up +44.8%; and Quanta Services up +33.7%.

Quite a few electrical manufacturers beat the S&P 500 Index as well as the NASDAQ Composite and Dow Jones Industrial Average. Over the past quarter, LSI Industries (+41.2%); nVent Electric (+37.8%); Acuity Brands (+29.8%); Legrand (+28.4%); Nexans (+28.1%); and ABB (+26.8%) took top honors for their 3Q 2025 share price increases. Several of these companies were sitting pretty year-to-date through Oct. 1, but none topped the share price performance increases of Dialight (+118.18%) or GE Vernova (+85.4%).

Distributor stocks didn’t fare quite as well, but WESCO’s share were up +14.7% for the third quarter and Ferguson plc was up +29.8% year-to-date. W.W. Grainger and Fastenal, usually two of the stronger-performing distributors, came in with softer results, with Grainger down -9.3% in 3Q 2025 and -10.2% YTD and Fastenal down -33.5% YTD.

EM’s editors also like to look at the market leaders when measured by cumulative and annual share price increases over the past five years back to Jan. 2020. Once again, its electrical contractors at the top of the list. IES Holdings has averaged a +298% annual increase since 2020 for a +1,491.7% cumulative return, followed by Quanta Services with a +185.7% annual return and EMCOR with +131.9% return. Eaton Corp. was the leading major manufacturer with a +58.3% annual return, and WESCO topped all distributors with a +52.3% annual return since Jan. 2020.