March’s Metro Area Contractor Employment Declines Look Worst in Louisiana and Texas

Although reports of a massive slowdown in construction across the United States are well-known, the construction employment data collected monthly by the U.S. Bureau of Labor Statistics (www.bls.gov) hasn’t quite caught up with the depth of the downturn.

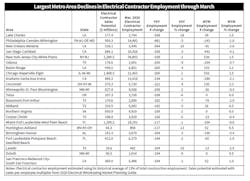

However, EM analysis of the latest available employment data showed some sizeable year-over-year declines in contractor employment in several states, with Louisiana down an estimated -1,157 electrical contractor employees from March 2019 for a -6% YOY decline. Because BLS break out electrical contractor employment at the national level but not at the state or metro level, Electrical Marketing uses the historical rule of thumb that electrical contractor employment represents 13% of total contractor employment at the national level.

At least half of Louisiana’s YOY decline in electrical contractor employment appears to be related to a -18% decline in electrical contractor employment in the Lake Charles, LA Metropolitan Statistical Area (MSA), which according to EM estimates had 598 fewer electrical contractor employees working in March 2020 than a year ago.

The impact of this employment decline on the state’s electrical sales potential is clear when you look at the sales-per-employee estimates for electrical contractors developed by Electrical Wholesaling for its 2020 Market Planning Guide. Each electrical contractor employee represents $66,617 in buying power, so the state of Louisiana is looking at $77.9 million less in electrical contractor sales in 2020, and Lake Charles will be hit with a decline of $39.2 million in electrical contractor sales potential. The New Orleans-Metaire MSA (down 364 employees YOY for a -10% annual decline); and the Baton Rouge MSA (down 260 employees for a -4% decline) also were amongst the nation’s MSAs with the largest annual drops in electrical contractor employment.

While it’s tough to say exactly why Louisiana is taking such a big hit in contractor employment, it’s possible several of the billion-dollar petrochemical projects that were underway there in recent years are either now complete or not employing as many electrical contractors. It’s also quite possible that the decline in the oil & gas market hit earlier in these metros than any declines caused by the COVID-19 coronavirus.

As you can see in the map below, that would appear to also be the case in Texas, where energy-dependent MSAs including Odessa, Beaumont-Port-Arthur, Midland and Corpus Christi all experienced significant YOY drops in electrical contractor employments, according to EM estimates.

We also noticed some large construction employment declines in the Philadelphia-Camden-Wilmington (MSA) — down 481 electrical contractor employees — and the New York-Jersey City-White Plains, NY-NJ MSA, down 338 employees. The construction industry in the Philadelphia metro and the entire state of Pennsylvania suffered a severe blow when Go. Tom Wolf shut down most projects last month. New guidelines for opening up the construction industry take effect on May 1.

EM’s editors crunched the BLS construction employment data for March to develop some estimates for electrical contractor employment at the state and MSA level to give our readers a very rough idea of where the employment situation stands in the electrical construction industry. We usually only publish employment data as a three-month moving average because of its volatility, but because of thirst for information on the industry’s economic conditions right now, we are breaking our own rules and running with BLS’ preliminary employment data for the month.

Construction industry analysts believe BLS’ April employment report due on May 8 will be the first employment indicator to truly measure just how many contractors have lost their jobs in recent months.

The Arlington, VA- Associated General Contractors (AGC) trade group tracks construction employment closely, and said in an April 28 release that construction employment declined in 99 out of 358 metro areas from March 2019 to last month “as the coronavirus pandemic triggered the first shutdown orders and project cancellations.”

“These new figures foreshadow even larger declines in construction employment throughout the country as the pandemic’s economic damage grows more severe,” said Ken Simonson, the association’s chief economist, in the release. “Unfortunately, the data for April and later months are sure to be much worse. In our latest survey, more than one-third of firms report they had furloughed or terminated workers — a direct result of growing cancellations.”