Top 50 Metropolitan Areas in NAED’s Western Region Enjoy Diverse Business Mix

Covering half the continental United States as well as Alaska and Hawaii, NAED’s Western Region is a vast market area that includes some of the fastest-growing cities and Metropolitan Statistical Areas (MSAs) in the country, much of the U.S. oil & gas industry, large swaths of new residential and downtown office construction, and a good chunk of the utility-grade wind farms and solar fields that have been built over the past few years.

Western Region distributors expect decent growth in 2015, according to Electrical Wholesaling’s 2015 Market Planning Guide. But EW’s forecasts say that with the exception of distributors in Alaska, California, Hawaii, Oregon and Washington, which in total are expecting 7% growth this year, wholesalers in other parts of the NAED Western Region forecast growth below the national mark of 6.2%. Distributors in the Mountain states (Arizona, Colorado, Idaho, Montana, New Mexico, Utah and Wyoming) see 5.6% growth; companies in the West South Central region (Arkansas, Louisiana, Oklahoma and Texas) expect a 2.9% increase; and the West North Central Region (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota) are also look at 2.3% growth.

No two MSAs in NAED’s Western Region are quite alike in their business mix or economic cycles. Cities in Upper Midwest states like Kansas, Iowa and Nebraska are chugging along at a more moderate growth and didn’t dip as bad as other parts of this region during the recession, while some fast-track markets like Dallas, Houston and San Francisco-San Jose were hit harder during the recession but are growing faster than most other metropolitan markets.

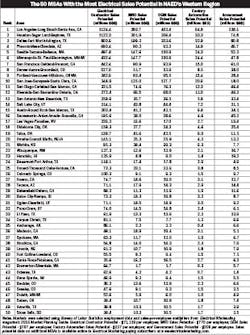

The sheer amount of electrical sales potential in some of these market areas also stand out. Los Angeles, Houston, Dallas individually have more electrical contractor sales potential than many states, and EW’s sales forecast say Los Angeles and Houston each have more than $1 billion contractor sales potential. (See chart on page 2 for the electrical sales potential in the Top 50 MSAs).

Some of this region’s projects underway business that stands out include a new downtown office tower for Sales Force in San Francisco; a new headquarters for Apple in Silicon Valley; Amazon’s new headquarters in Seattle; and the Tesla plant outside of Reno, Nev. And as the export facilities for LNG (liquefied natural gas) win approval, there will some gigantic new plants underway along Texas’ Gulf Coast.