Electrical Distributors See Slow Growth and Conservative Investment Scenario in 2017

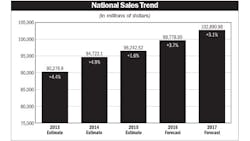

It’s probably not a big surprise to many execs in the electrical industry that distributors are expecting slow growth in 2017. The 3.1% growth rate that distributor readers of Electrical Wholesaling magazine forecast in a recent survey is under the 4% to 8% average growth rate that the industry typically sees. While 3.1% growth is nothing to cheer about, it’s still above the 2.1% increase in Gross Domestic Product (GDP) that the Fed’s Federal Open Market Committee expects for next year.

The Electrical Wholesaling survey, which has been conducted annually since the 1970s for the magazine’s Market Planning Guide published each November, didn’t show any regions of the country with much higher growth prospects than the national average, although the West North Central, Mountain and Pacific regions were all over 4%.

On the flip side, distributors in the Northeast region were clearly more pessimistic than other respondents, as New England distributors see marginal growth of 0.4% and distributors in the Middle Atlantic region expect growth of 0.8%.

Electrical distributors provided some intriguing details on their forecasts and the investments they plan to make in their companies in 2017. EM’s editors found it interesting that of the 162 respondents expecting sales growth next year, about 57% said they would get that growth primarily from overall growth in the market and 43% said they would grow by taking market share from competitors.

It’s also interesting that approximately 71% said they didn’t have any major investments planned for next year. For those companies that do plan to make significant investments next years, the most popular equipment was as follows: delivery trucks (68.2%); tablet computers (30.3%); material handling equipment (45.5%); smartphones (34.8%); tablet computers (30.3%); and ERP systems (10.6%);

This hesitancy on the investment front also seemed to carry through on respondents’ hiring plans for 2017. Only 26.9% of respondents said they plan to hire new employees next year, and 36.1% said they would be hiring new employees only when jobs open up. Thirty-five percent of the distributors said they do not anticipate hiring any new employees next year. Less than 2% of respondents said staff reductions seem likely next year.

Electrical distributors also had some interesting observations about where copper prices are headed next year. Roughly 43% of the respondents see copper staying about where it’s been this year, between $2 per pound and $2.25 per pound. Over a third of respondents see copper prices between $2.26 per pound and $2.50 per pound, and about 6% of respondents see copper prices north of $2.75 per pound.