AIA Consensus Construction Forecasts Points to Slower Growth in 2014 & 2025

Jan. 25, 2024

2 min read

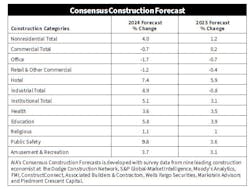

After an unusually strong performance in 2023, the construction sector will see weaker conditions this year and next, according to the American Institute of Architects’ recently published 2024 Consensus Construction Forecast. AIA’s construction forecasts, which are updated twice-each-year, and its monthly Architecture Billings Index are two of the best leading indicators available in the construction market.

AIA's Consensus Construction Forecast is developed through surveys of leading construction forecasters: Dodge Construction Network, S&P Global-Market Intelligence, Moody's Analytics, FMI, ConstructConnect, Associated Builders & Contractors, Wells Fargo Securities, Markstein Advisors and Piedmont Crescent Capital.

This year’s forecast provides the most recent update of nonresidential building forecasts for 2024 and provides the first look at 2025. Kermit Baker, AIA’s chief economist, wrote in the forecast, “After increasing by more than +20% last year, spending on nonresidential buildings will see a much more modest +4% increase in 2024, at a pace that will slow to just over +1% growth in 2025. Spending on commercial facilities will be flat this year and next, manufacturing construction will increase almost +10% this year before stabilizing in 2025 and institutional construction will see mid-single-digit gains this year and next.“Recently-enacted federal programs provided some of the latest boosts to construction spending on buildings, Baker wrote. “The CHIPS and Science Act, enacted in 2022, has boosted manufacturing spending by providing funding to high-tech hubs and semiconductor manufacturing. The Inflation Adjustment Act, also enacted in 2022, has provided funding for the electrification of homes and incentives for energy-efficient commercial reconstruction and building.“Finally, the Infrastructure Investment and Jobs Act, enacted in 2021, provides funding for traditional infrastructure, which eventually will encourage more building construction in conjunction with these infrastructure investments.“Even though construction spending remains strong in virtually all nonresidential construction categories, other indicators confirm that a construction slowdown is underway. By the latter part of 2023, construction starts had either slowed dramatically or turned negative in virtually all construction sectors. The value of nonresidential building starts increased a mere +2% through the first 11 months of 2023 as compared to the same period in 2022, according to ConstructConnect.”The AIA Consensus Construction Forecast is available at www.aia.org/resource-center/january-2024-aia-consensus-construction-forecast