More Multi-Billion Dollar LNG Export Terminals to Start Producton in 2019

Editor’s note. Export terminals that process liquefied natural gas (LNG) for shipment overseas top most lists of the largest industrial projects now underway in the United States.

Victoria Zaretskaya and Nicholas Skarzynskir from the U.S Energy Information Administration (EIA) (www.eia.gov), recently did an analysis on the growth of LNG export facilities in EIA’s Today In Energy online report. That report is excerpted below. Click here for the full report on the EIA’s website.

EIA projects that U.S. liquefied natural gas (LNG) export capacity will reach 8.9 billion cubic feet per day (Bcf/d) by the end of 2019, making it the third-largest in the world behind Australia and Qatar. Currently, U.S. LNG export capacity stands at 3.6 Bcf/d, and it’s expected to end 2018 at 4.9 Bcf/d as two new liquefaction units (called trains) become operational.

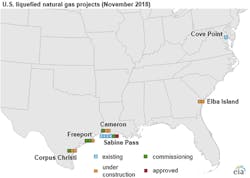

The U.S. began exporting LNG from the lower 48 states in Feb. 2016, when the Sabine Pass liquefaction terminal in Louisiana shipped its first cargo. Since then, Sabine Pass has expanded from one to four operating liquefaction trains (the liquefaction plant where natural gas is processed), and the Cove Point LNG export facility began operation in Lusby, MD. Two more trains — Sabine Pass Train 5 in Cameron Parish, LA, and Corpus Christi LNG Train 1 — began LNG production in 2018, several months ahead of schedule, and were expected to ship their first cargos in late 2018 or early 2019.

Two more LNG export facilities — Cameron LNG near Calcasieu and Cameron Parish, LA, and Freeport LNG in Freeport, TX — are currently being commissioned. The first LNG production from these facilities is expected in the first half of 2019. The developers of these projects expect all three trains at Cameron LNG and two trains at Freeport LNG to be placed in service in 2019.

The Elba Island LNG facility near Savannah, GA, is also scheduled to become fully operational by the end of 2019. Elba Island LNG consists of 10 small modular liquefaction units with a combined capacity of 0.33 Bcf/d. Project developers expect LNG production from the first train to begin early next year and from the remaining nine trains to commence sequentially through the rest of 2019. The second train at Corpus Christi LNG is scheduled to be placed in service in the second quarter of 2019. The final two trains of the U.S. liquefaction projects currently under construction — Freeport Train 3 and Corpus Christi Train 3 — are expected in service in the second quarters of 2020 and 2021, respectively.

Four additional export terminals — Magnolia LNG, Delfin LNG, Lake Charles, Golden Pass — and the sixth train at Sabine Pass have been approved by both the U.S. Federal Regulatory Commission and the U.S. Department of Energy, and they are expected to make final investment decisions in the coming months. These proposed projects represent a combined additional LNG export capacity of 7.6 Bcf/d.

U.S. LNG exports continue to increase with the growing export capacity. EIA’s latest Short-Term Energy Outlook forecasts U.S. LNG exports to average 2.9 Bcf/d in 2018 and 5.2 Bcf/d in 2019 as the new liquefaction trains are gradually commissioned and ramp up LNG production. The latest information on the status of U.S. liquefaction facilities, including expected online dates and capacities, is available in EIA’s database of U.S. LNG export facilities.

—Victoria Zaretskaya & Nicholas Skarzynskir, U.S. Energy Information Administration