Sunny Side Up: The electrical industry's economic indicators look strong for the rest of 2017

As we go to press, we are just a month shy of being half way through this year. As you read this, you have five months’ year-to-date sales and probably can already see how your year is going to wind up.

We can share with you how we see the electrical distributor market progressing so you can benchmark and track your company’s performance. We track industry sales every month.

Tracking 2017

We are more optimistic at this point than we were at the beginning of the year. In January, we were projecting 2017 industry sales to advance 5% from the 2016 level.

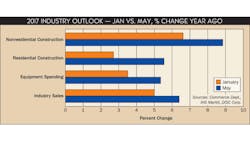

I think it would be useful if you saw why our view has become more optimistic in the following chart.

There are incremental changes to the key economic drivers, all increasing in our May analysis compared with our January analysis. These are the higher-level numbers and in our monthly FLASH Update we dig into the underlying reasons for these changes. The reason we track industry performance every month is because we are in a dynamic economy. Whether the economy is weak or strong, the dynamics that affect the electrical industry’s fortunes are always changing.

Market Segment Changes

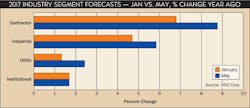

A good forecast will identify the changing dynamics and tie industry sales to it. That said, look how the changing dynamics have affected our market segment projections.

While total industry sales are interesting numbers it’s the market segments that are most useful in managing your business, and positioning your resources for productive growth.

My take away:

The fundamentals are strong in the electrical distributor served markets. The construction markets are solid.

Distributor Prices

One key issue at this point is how fast distributor prices are rising and are going to rise this year. The question is, will your competitors force you to absorb rising prices or do you have strength in your trading areas to raise your prices without fear of losing share?

We are projecting overall distributor prices to increase about 1½% this year. We could be under-forecasting prices, which could be up closer to 2½%. A difference of 1 percentage point in prices translates into a 1% difference in our sales forecast.

As a reference point, last year we saw prices falling more than 2½%. The question is how do you handle these price changes going from negative to positive in hotly competitive trading areas?

From a cyclical point of view, we are still forecasting 2017 to be the strongest electrical industry growth year over the next four years. We are not forecasting an industry downturn, we do not see any industry negative growth but beyond this year we do not see industry sales exceeding 4%.

Stay tuned. The dynamics change and when they do, we will capture them.

If you have any questions about DISC’s subscription-based data services, contact Herm at 203-799-3673 / [email protected].