Hitting the Hot Spots: Three Markets with the Most Electrical Sales Potential in 2014

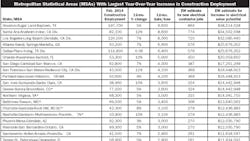

While energy market-related business continues to drive some of the fastest growth in the nation, construction business in some areas outside the oil and gas producing regions is putting some other Metropolitan Statistical Areas (MSAs) on the map, too.

Many Florida MSAs have seen big gains in construction employment, and the housing markets in some other cities that historically have been big-time homebuilding meccas like Atlanta, Dallas, Denver, Houston and Phoenix are starting to heat up, too. But our picks for the three market areas showing the most promise this year for distributors, manufacturers, reps and end users are the Midland-Odessa oil patch; Louisiana’s Gulf Coast; and Southern California.

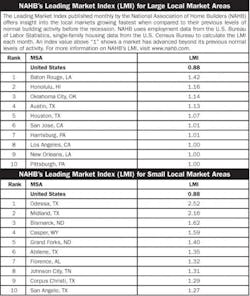

Midland-Odessa. While you might think it’s all about oil in the Midland-Odessa region of West Texas, where the famed Permian Basin is still gushing with oil, this region also had some of the healthiest housing markets, according to the National Association of Home Builders (NAHB), Washington, D.C. As you can see in NAHB’s Leading Markets Index on page 2, Midland and Odessa showed the most growth of any smaller metros compared to their historical norm of building activity.

Ingham Economic Reporting, Amarillo, Texas, which publishes the monthly Midland-Odessa Regional Economic Index recently reported,“The estimated volume of crude oil production is up by about 12% thus far in 2014, and the industry continues to add employment in the metro area with direct oil and gas related employment up by 7% compared to this time last year… “The construction sector in the combined metro area remains on fire, and the $63 million in building permit valuations were up by about 47% compared to February of a year ago, pulling the year to date total up by over 36% compared to the first two months of 2013.”

One distributor riding the wave of economic activity in this region is Carl Long, president of Odessa Winlectric. He recently won WinWholesale’s 2013 Overall Company of the Year award for guiding his branch to well over $20 million in 2013 sales.

Louisiana’s Gulf Coast. When summarizing the booming economy along Louisiana’s Gulf Coast, the state’s Cajun community might say, “Laissez les bons temps rouler!” — “Let the good times roll!” A mix of energy business, shipping, industrial construction and residential construction in the Baton Rouge market have added plenty of spice to an economic gumbo that should feed the area’s economy for years to come.

An Oct. 13 article in an area newspaper, The Advocate, said approximately $12.6 billion in public construction projects are either planned or underway in New Orleans, including the $1.06 billion University Medical Center; the nearly $1 billion VA Hospital, the $224 million Orleans Parish Prison complex; an $826 million overhaul of Louis Armstrong International Airport; and $1.6 billion in public housing projects. The industrial projects mentioned in the article include the $850 million Dyno Nobel International ammonia production facility; the $721 million Nine Mile Power Plant Entergy is building and plans by Valero Refinery for a $700 million methanol unit in the area.

The Advocate article also said the Baton Rouge economy is “being driven by the $23.7 billion in industrial projects that are either under construction or have been announced,” and that in southwest Louisiana, the Lake Charles area is the state’s fastest-growing area, with $46.6 billion in industrial construction projects,” including Sasol’s massive gas conversion complex expected to be worth up to $16 billion-$21 billion.

Lake Charles is expected to add 7,800 new jobs through 2015, according to the article, and NAHB pegged Baton Rouge as the fastest-growing large MSAs in its LMI report. U.S. Bureau of Labor Statistics’ data shows that the Lake Charles and Baton Rouge MSAs have added a combined 4,900 construction jobs year-over-year through February. The increase in electrical contractor employment should bolster electrical products sales in these two markets by roughly $20 million, according to Electrical Wholesaling’s sales estimates.

Southern California. California’s construction industry was hit hard by the recession, but it’s on the comeback trail. Overall the state has added 38,800 construction jobs year-over-year through February for a healthy 6.2% increase, but at least 62% of these new jobs (23,900) are in Southern California from Los Angeles, Orange and Riverside Counties, and south down to San Diego. According to Electrical Wholesaling’s local market sales potential data, that means electrical contractors have added an estimated 2,150 employees to the payroll and will have an additional $98 million in buying potential this year.

These contractors will be working in a regional housing market that tallied 41,400 total annual building permits in 2012 (52% of California’s total); the ongoing redevelopment of Long Beach, Calif.’s port and the related intermodal transportation projects nearby and east into Riverside County; utility-scale solar farms; retrofit work at Los Angeles’ LAX airport; the new $4 billion 210-acre Millenia community being built south of San Diego; the $400 million Columbia Square project underway in Hollywood; and the upcoming $520 million expansion of the San Diego Convention Center.