2026 Construction Pipeline Loaded with Hospital, K-12 School and University Projects

Data centers will dominate the construction market again in 2026, but don’t sleep on the medical and educational markets next year. Judging from the number of projects in these markets valued at more than $100 million now in the construction pipeline, they should offer solid growth prospects in 2026.

Hospitals

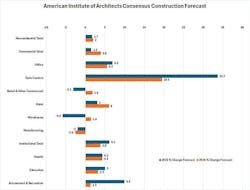

AIA’s Consensus Construction Forecast anticipates +4.3% growth in its Health segment, dead even with its anticipated growth in 2025. EM found at least 27 hospital projects valued at $200 million or more in the pipeline.

Over the past two years, the largest hospital projects making news included the $3-billion Cooper University Health Care hospital expansion in Camden, NJ, that entered the planning stage in Feb. 2025; the $1.5-billion Lyndon B. Johnson Hospital replacement in Houston, TX, that began construction in May 2024; and the $1-billion Intermountain Health St. Vincent Regional Hospital, in Billings, MT, that announced plans in Nov. 2024

Schools & universities

AIA’s Consensus Construction Forecast anticipates +3.2% growth in its Health segment, down from 2025’s +5% growth. While facility construction projects at K-12 schools and universities often aren’t as large as the mega-projects in other areas of the nonresidential construction market, EM found 26 projects with at least $100 million in total contract value in the pipelines.

The largest were the $842-million University of California-San Francisco academic building underway in San Francisco, CA; the $493-million Revere High School project in Revere, MA, now in the planning stage; a $465-million dormitory planned for the University of California in Berkeley, CA; and the $420-million Phillip A. Levy Engineering Center underway at the University of Wisconsin in Madison, WI.

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).