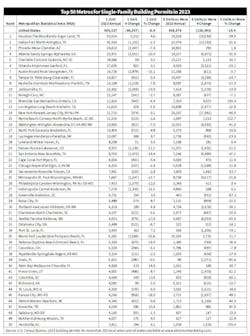

Last year was not the best of times for U.S. single-family building permits because high mortgage rates scared away potential homebuyers. At the national level, in 2023 single-family building permits slid -6.8% (-66,357 permits) to 909,227.

But builders in two of the nation’s most active housing markets were still pulling permits at a rate far exceeding the national average. For instance, in the Houston-The Woodlands-Sugar Land, TX MSA, the nation’s largest market for single-family permits, topped 50,000 and increased +4.8% (see chart on page 2). The only other metro in the Top 10 to register an increase was Orlando-Kissimmee-Sanford, FL, where permits hit 17,035 due to a +5.1% increase. The other markets in 2023’s Top 10 were Dallas (42,543/-2.5%); Phoenix (24,810/ -7.6%); Atlanta (23,972/-10%); Charlotte (19,088/+0.3%); Austin (16,738/-15.1%); Tampa (14,827/-5.4%); Nashville (14,169/ -7.9%); and Jacksonville (12,402/-13.9%).

The National Association of Home Builders (NAHB) expects single-family building permits to increase +4.6% in 2024 and +8.5% in 2025. In a post at www.nahb.org, NAHB said it’s projecting that single-family production will rebound to a 925,000 annual pace in 2024.

“The 2022 and 2023 declines appear dramatic because production was running at a very solid level above a 1.1 million annualized pace through the first quarter of 2022 before beginning a steep decline as mortgage rates rose rapidly and the housing market weakened,” said NAHB.

When you look at single-family permits over the past five years, you will see some number that show that despite the high interest rates and COVID-19 challenges, home construction in the hottest markets was absolutely booming.

Check out how many single-family permit were pulled from 2019-2023 in the five most active markets: Houston (239,856); Dallas (217,128); Phoenix (142,698); Atlanta (137,048); and Austin (101,937).

Despite its recent challenges, the single-family construction market remains one of the key market segments for the electrical wholesaling industry. Depending on the individual local market dynamics and housing demand, it typically accounts for 7.6% of sales through electrical distributors. In 2024, Electrical Marketing estimates that could be $11.2 billion, unadjusted for inflation.

Single-family building permits are an important leading economic indicator to watch because permits are typically pulled several months before builders break ground on a new house. These permits are also usually a harbinger of other construction activity to come, because once a large housing development goes in, light commercial construction typically follows, such as strip shopping centers, gas stations, restaurants and other retail buildings.