When evaluating your local market’s growth prospects, some pretty simple economic indicators can help gauge where business may be headed in the near future. You can’t go too far wrong by first looking at one key filter: comparing your local county, Metropolitan Statistical Areas (MSAs) or state with the national growth rate for these key indicators:

- Population growth from 2017 to 2022 and from 2021 to 2022

- Electrical contractor and/or electrician employment

- Single-family and multi-family building permits

- Construction projects in the planning process or getting ready to break ground

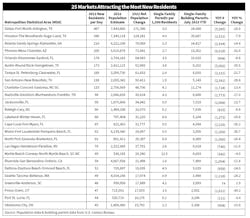

The fastest-growing local markets are usually cranking along at double the national rate of growth, or their state’s rate of growth for population, electrical contractor or electrician employment and building permits. The chart on page 2 shows our picks for 25 MSAs that will offer solid growth potential in 2024. You will find that metropolitan areas in Texas and Florida dominate the list, with all of the largest metros in Texas ranked, as well as most of Florida’s major metros.

As has been the case over the past years, the fast-growing MSAs along Florida’s Gulf Coast, are well represented. Year-after-year, they see double-digit population growth to fuel demand for new vacation homes, senior housing and single-family homes for new residents from colder climates. Unfortunately, some of the growth of these markets over the past year must be attributed to reconstruction efforts from last fall’s Hurricane Ian.

Industrially oriented electrical contractors may also want to compare their local markets with some of the areas seeing a surge of business from the new electric vehicle factories, EV battery plants or semiconductor fabrication facilities now being built. Arizona, Georgia, Kansas Kentucky, Michigan, Ohio and Tennessee and are just a few of the states cashing on these new projects.

Employment data

The U.S. Bureau of Labor Statistics provides construction employment data at the county, MSA, state and national level and electrician data at the MSA, state and national level. BLS releases electrician data for the previous year annually. The 2022 electrician employment data (tabulated for May 2022) was released in April, 2023 at www.bls.gov.

Electrical contractors

The U.S. Census Bureau releases national electrical contractor employment data each month at www.bls.gov, but does not break out its electrical contractor data by state, county or MSA. However, you can multiply that data by 13% to get a realistic estimate for the contractor count in those markets.

Population growth

There’s a direct correlation between the number of new residents moving into (or leaving) a market area and the level of residential construction activity, which in turn feeds the construction of strip shopping centers and other retail areas, new schools and hospitals and other commercial and institutional construction. Population data can help you develop two other interesting local growth indicators – the number of residents moving into or out of a local area each day and the number of building permits per 1,000 residents. Tabulating the new residents per day in a local market is a quick-and-easy indicator that gives you a sense of just how fast a market is growing (or shrinking, if population is declining and more people are moving out of an area than moving into it). Click here for population data at the local level.

Building permits

The U.S. Census Bureau publishes monthly building permit data at the national, MSA and state level at www.census.gov

You can access updated electrical contractor data for more than 300 MSAs and over 1,000 counties at www.electricalmarketing.com.