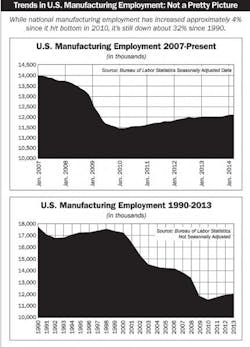

Although the U.S. industrial market has not fully recovered from the recession, when manufacturing employment tumbled to historical lows (see chart on page 2), some regions of the country are finally seeing some solid employment growth. Surprisingly, it’s the industrial Midwest leading the way, followed by Texas, the Bay Area and Florida.

With the preliminary employment data through March 2014 now in from the U.S. Bureau of Labor Statistics, six Midwestern states can be counted among the 10 states showing the largest year-to-year employment increases — Michigan, Indiana, Ohio, Wisconsin, Minnesota and Missouri. Since March 2013, these states have added 55,600 manufacturing jobs. Within these states, the metropolitan statistical areas (MSAs) showing the most job growth since March 2013 include Detroit-Warren-Livonia, MI (+7,200); Warren-Troy-Farmington Hills, MI (+5,800); Minneapolis-St. Paul-Bloomington, MN-WI (+4,400); Cincinnati-Middletown, OH-KY-IN (+2,800); Toledo, OH (+2,300); and Grand Rapids-Wyoming, MI (+2,200).

The additional sales potential for each of these new jobs is substantial when you consider that according to Electrical Wholesaling’s 2014 Market Planning Guide’s sales forecast data published in the Nov. 2013 issue, every manufacturing employee at a plant is worth $695 in MRO (maintenance and repair operations) sales and $711 in OEM (original equipment manufacturer) sales. Using the magazine’s 2014 sales-per-employee estimates means the increase in manufacturing employment in these six states is worth an additional $38.64 million in additional MRO sales and $39.53 in OEM sales.

Texas’ energy market is getting all the ink these days, but the state is seeing some good growth in manufacturing since the recession, too. Manufacturing employment has increased by 14,100 employees over the past year, led by the Houston-Sugar Land-Baytown, TX MSA (+6,900); Fort Worth-Arlington, TX Metropolitan Division (+3,100); and Austin-Round Rock-San Marcos, TX (+1,200). With this employment growth, Electrical Wholesaling’s sales potential estimates for Texas’ MRO and OEM markets have increased by $9.8 million and $10 million, respectively.

Although the Bureau of Labor Statistics employment data does not break out types of manufacturing employment at the MSA level, it’s not much of a stretch to figure that much of this growth is related to the development of new facilities or the retrofit of existing facilities in the petrochemical industry.

The growth of California’s technologies industries has been in the news lately, too, and supporting some of the growth are new manufacturing jobs in Silicon Valley and throughout the Bay area. Northern California’s Bay Area added 11,500 manufacturing jobs since March 2013, with the San Jose-Sunnyvale-Santa Clara, CA (+6,700); San Francisco-Oakland-Fremont, CA (+2,700); and Oakland-Fremont-Hayward, CA Metropolitan Division (+2,100) accounting for most of the growth. In total, the new jobs created in the Bay Area means that over the past year there’s an additional $8 million in MRO sales and $8.2 million in OEM sales to be had, according to Electrical Wholesaling sales-per-employee estimates.

Rounding out these industrial hotspots is Florida, with at least 9,800 new manufacturing jobs since March 2013. Leading the way is the Tampa-St. Petersburg-Clearwater, FL metropolitan statistical area with 4,100 new jobs, followed by Miami-Fort Lauderdale-Pompano Beach, FL MSA (+2,000); Miami-Miami Beach-Kendall, FL Metropolitan Division (2,000) and Orlando-Kissimmee-Sanford, FL (1,700). With these new jobs, Florida’s industrial MRO and OEM sales potential increased by $6 million and $7 million, respectively, according to Electrical Wholesaling’s forecast data.

Some other metropolitan areas have been showing strong growth, too, but you need to take a step back and look at a few more years of historical data. The Seattle-Bellevue-Everett, WA Metropolitan Division MSA has added 3,000 new jobs since 2007, and Baton Rouge, (+1,400) and Lafayette, La. (+2,500); Florence-Muscle Shoals, Ala. (+2,200) and Mobile, Ala. (+2,700); and Charleston-North Charleston-Summerville, SC (+1,700); and Greeley, Colo. (+1,300) were the other metropolitan statistical areas with the best growth in manufacturing employment since 2007. It’s no surprise that some cities in Louisiana are enjoying job growth, considering the colossal growth in the state’s energy market.

Overall, construction economists remain fairly bullish on the industrial market for 2014 and 2015, according to the Consensus Construction Forecast published by the American Institute of Architects (AIA), Washington, D.C. This forecast calls for 7.8% growth in the industrial segment of the construction market for 2014 and 8.7% growth in 2015. The forecast is a compilation of construction estimates by McGraw- Hill, IHS-Global Insight, Moody’s Economy.com, FMI, Reed Construction Data, Associated Builders and Contractors and Wells Fargo Securities.