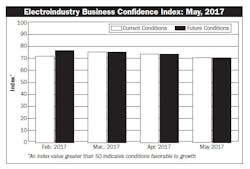

NEMA’s Current and Future EBCI Indexes moved in lockstep for the third consecutive month, each pulling back nominally from 73.5 points last month to 70.6 points in May. At this level the indexes remain well into expansionary range, even as the current conditions responses suggest a movement toward a sense of status quo with the six-percentage point decline in those registering better conditions — from 53% in April to 47% now — taken up entirely by the six point increase, to 47%, in those seeing unchanged conditions.

The EBCI Index is a monthly survey of senior executives at electrical manufacturers published by the National Electrical Manufacturers Association (NEMA), Rosslyn, Va. Any score over the 50-point level indicates a greater number of panelists see conditions improving than see them deteriorating.

Those witnessing worse conditions held steady at 6%. Comments were largely positive, with a dash of uncertainty about specific end use sectors including the industrial and utility markets. A majority of respondents expect improved conditions in six months, although the 53% share of those who do marks a sharp pullback from the 65% reporting similarly last month. Unlike the current conditions reporting, the share of those expecting worse conditions declined from 18% last month to 12% in May. The largest swing came from those expecting conditions to remain unchanged. That share jumped from 18% in April to 35% this month. Comments regarding expectations for the business environment tend to be upbeat but political uncertainty remains a concern.