The general mood of the economists and other presenters at the 2014 Dodge Construction Outlook, held Oct. 24-25 in Washington, D.C., can best be summarized by the earworm lyric for the 1970s hit song from the Little River Band — “Hang on/Help is on its way.”

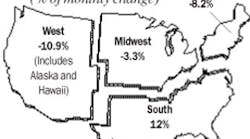

While the construction market will probably maintain its slow, methodical pace to recovery in the short term, some macroeconomic drivers could push the market to much better growth over the next decade. McGraw-Hill Construction says spending related to total U.S. construction starts for 2014 will rise 9% to $555.3 billion, higher than the 5% increase to $508 billion estimated for 2013. That forecast will vary on a region-by-region basis. Some metropolitan areas, including Washington, D.C., Boston, New York and the San Francisco Bay Area, are already enjoying marked improvement from the depths of the Great Recession, while others may not see a major rebound over the next few years.

Two of the economists on the program, Robert Murray, McGraw Hill Construction’s V.P. of economic affairs, and Beth Ann Bovino, chief U.S. economist for Standard & Poor’s, both expect the oil-shale boom to continue to drive long-term economic growth by offering less-expensive energy that the United States can export offshore and use to lure manufacturing back to this country. Murray told the 200-plus attendees at the conference that he expects “modest growth” in the 2014 construction market and not a boom. Some key contributing factors to his forecast include fiscal restraint on the federal spending level; more bond issues passing on the state and local level to fund construction of schools and other public facilities; the increasing office employment and declining office vacancy rates in some key downtown markets; and a positive picture for the housing market. He did caution attendees that in the case of the office construction market, the 87 million square feet he sees in new office construction — a 16% increase from 2013 — is still well below the recent peak of 218 million square feet in 2007. He also is closely watching which markets will see this new construction and said, “The big question is if major office construction will move to smaller markets.”

Standard & Poor’s Bovino was particularly encouraged by the housing recovery, and said even though some of the growth over the last few years has been off the charts in some local markets, higher interest rates will keep another housing bubble at bay. The other positive factors she sees in today’s U.S. economy include the increase in consumer spending, the decline in consumer debt, and the return of manufacturing to the United States because of cheap energy and more investment in industrial facilities because of improving capacity utilization rates.

Dean Oskvig, president of Black & Veatch’s Energy Business, also said an increase in natural gas production in the United States could have a dramatic impact on the nation’s economy because it can be used efficiently and inexpensively in so many industries, including the rail, marine, trucking and auto industries. He also said Black & Veatch believes that under the right regulatory circumstances natural gas could go from providing 28% of the U.S.’s net electricity in 2013 to 57% in 2037, gaining the most share from coal, which he said could decrease from 30% to 9% over the same time period.

While many of the speakers in the conference focused on national or global economic outlook as it relates to the construction market, one of the panels focused on the major issues facing property owners, developers, investors and construction firms. The panel, moderated by Scott Kolbrenner, managing director & head of engineering & construction for Houilhan Lokey, focused on one of the healthiest construction markets in the country — the Washington, D.C./Baltimore metropolitan area.

The panelists, James Dinegar, president and CEO, Greater Washington Board of Trade; Daniel McQuade, chief executive, Tishman Construction/AECOM; and Dorothy Robyn, commissioner, public buildings service, U.S. General Service Administration (GSA); are all intimately familiar with the multitude of construction projects underway in the Washington/Baltimore region. The area now offers a unique blend of new construction and retrofits of millions of square feet of government and private office space; a major mass transit project in the extension of the Metro line to Dulles Airport; and port and rail construction in Baltimore. The panelists said much of the construction is green, and agreed that sustainable development is no longer a trend, it’s just the way business is done nowadays in the design, engineering and construction world.

Another trend unique to this region is the humongous impact the federal government has on the real estate market in Washington/Baltimore because it owns or leases so much of the office space in the area. In her post at GSA, Robyn manages not only all of the federal government’s building inventory in this region but throughout the country — a grand total of 375 million square feet of office space that houses more than one million federal workers. Three of the major trends that she deals with daily are the retrofit of historically significant buildings with the latest in energy-efficient design, the overall impact green construction has had on building or retrofitting facilities for energy-efficiency and the move toward more open office environments. McQuade agreed with Robyn on the trend toward green and said Tishman is seeing lots of green building and a move toward collaborative work spaces/open office environments. His company worked with GSA in providing open office space on the six floors GSA is leasing at One World Trade Center in New York.

Dinegar said a big construction trend in the D.C./Baltimore market is the amount of work being done for the government for security and cyber-surveillance entities, including a huge data center for the National Security Agency (NSA) in Fort Meade, Md. He half-jokingly said the computer personnel at these security and cyber agencies are working on “the important stuff,” while the computer folks in Silicon Valley are working on the next Angry Birds game.

In a press release summarizing his comments during the forecast presentation, McGraw-Hill Construction’s Murray said, “We see 2014 as another year of measured expansion for the construction industry. Against the backdrop of elevated uncertainty and federal spending cutbacks, the construction industry should still benefit from several positive factors going into 2014.

“Job growth, while sluggish, is still taking place. Interest rates remain very low by historical standards, and in the near term the Federal Reserve is likely to take the necessary steps to keep them low. The bank lending environment is showing improvement in terms of both lending standards and the volume of loans. And, the improving fiscal posture of states and localities will help to offset some of the negative impact from decreased federal funding.”

“The 2014 picture bears some similarity to what’s taking place during 2013, with single-family housing providing much of the upward push; multi-family housing showing a slower yet still healthy rate of growth after four years of expansion, and commercial building gradually ascending from low levels. One change that’s expected for 2014 is that institutional building will no longer be pulling down nonresidential building and total construction.”