There are many ways of analyzing markets, none of which would be considered to be an exact science, but various approaches can help to put things into perspective. For example, aluminum inventories held in LME warehouses have declined 1,097,025 MT thus far this year, or about 100,000 MT per month. At that rate, current LME stocks of 1,108,900 will be completely depleted by this time next year. But that’s a stretch of course, as a lot can happen between now and then.

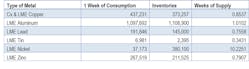

If we look at global consumption of metals on a weekly basis in the chart below, relative to inventories held in Comex and LME inventories, as the table below illustrates, there is less than one week of copper in inventory; about a weeks’ worth of aluminum consumption, but nearly 10 weeks of nickel consumption.

John Gross publisher of The Copper Journal and is one of the metals' industry's best resources on copper pricing trends. If you would like to learn more about how to manage your wire and cable inventory in this volatile market environment, email John at by clicking here or calling him at 631-824-6486.As a point of reference, at the end of last year, aluminum inventories stood at 2,205,925 MT, representing about 2 weeks of consumption. Clearly, the numbers are subject to interpretation, as they don’t include Shanghai inventories, or for that matter, inventories held by producers, merchants, or consumers, but they do nevertheless provide a broad overview of global market conditions.