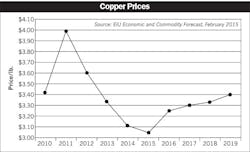

Factors ranging from slowness in the Chinese economy to concerns about the potential impact of a Greek debt default have kept copper pricing low from the start of the year and many analysts are forecasting continued softness through the rest of the year.

Since hitting a peak in spring 2011 at around $4.60 per pound, the trend has been generally downward. Prices hit a fresh three-month low this week at $2.6155 per pound after reports that stimulus measures in China would be insufficient to boost expansion in the economy of the global market’s largest copper consumer.

Fundamentals seem to suggest some support for prices is building. Inventory levels, though still in surplus, have fallen from 2014 levels at all three major exchanges; growth continues in China though the rate of that growth has fallen; and production is seeing a decline in the quality of ore being produced at some major mines.

Those fundamentals might be enough to justify a rising price. Indeed, there are analysts forecasting a shift from the surplus seen today to a significant deficit by 2018 and prices in the $4 range. But some copper analysts are beginning to question whether fundamentals are relevant at all to pricing right now. Other factors may be more influential and their impact is inscrutable.

Among these factors, stimulus money flowing into the global economy from central bank quantitative easing programs has boosted pricing on commodities and equities across the board, but the size of their influence is hard to judge against a backdrop where the U.S. Federal Reserve is expected to raise interest rates while Europe continues its stimulus programs and China is in the middle of what looks like a continuing series of rate cuts and other stimulus measures. The value of the dollar against other currencies is also a confounding factor. Even the level of copper inventories remains obscured by the lack of transparency into stocks held in China’s bonded warehouses.

In its 2015 survey of mining companies, released recently, PricewaterhouseCoopers said copper miners are basing long-term plans on prices averaging $3.11 per pound. So far in 2015, copper hasn’t seen even $3.

Copper analyst John Gross told Electrical Marketing this week that the confluence of unknown factors affecting copper has made it almost pointless to try to forecast a price for the metal. Gross offers a regression to the mean analysis that suggests the current price should be around $2.36, well below the actual price of $2.60-$2.63, but the outside variables make it hard to build an argument for one scenario over another.